A Lesson For Australia And The World On Weathering A Housing Crash

The Lone Star State Schools The Rest

In the debate surrounding housing prices there is often a focus on the damage that a major fall in prices or an outright crash could do to the broader economy. Which raised an interesting question in my mind, how possible is a housing crash in a market where prices didn’t become deeply overvalued in the first place.

After a bit of research on the underlying conditions of different markets which have experienced significant economic difficulty in recent decades and the potential available data, the U.S state of Texas during the Global Financial Crisis emerged as the best candidate for an in depth assessment.

In order to get a get a handle on the relative performance of the Texas housing market during this era, we’ll also be looking at the Texan economy, labour market and foreclosure rates, as well as some commentary from academia.

A Bit Of Background - The Lone Star State

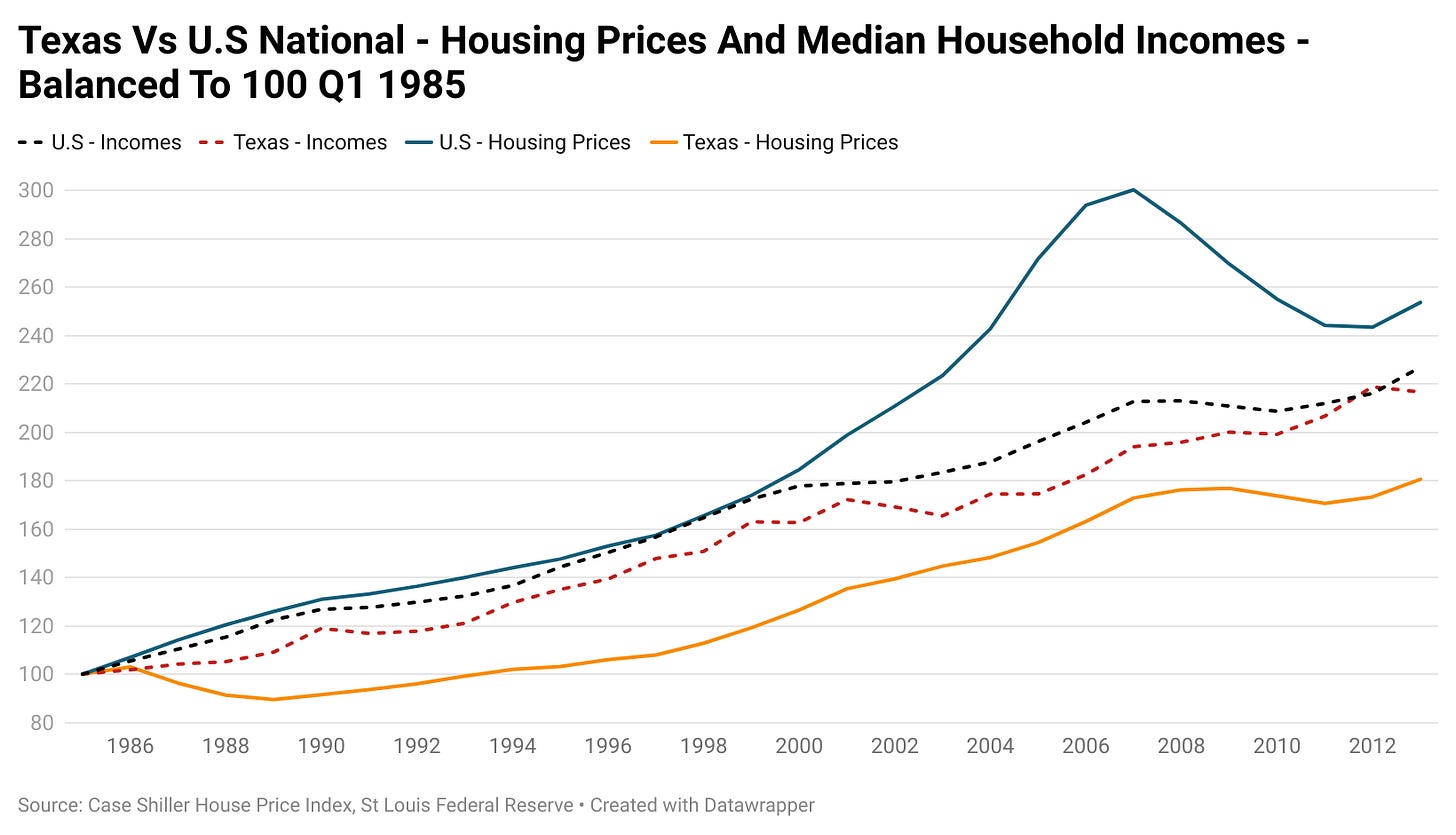

To find the point of major divergence between Texan and national U.S housing prices, we need to go back to the days of Marty McFly and Doc Brown, 1985.

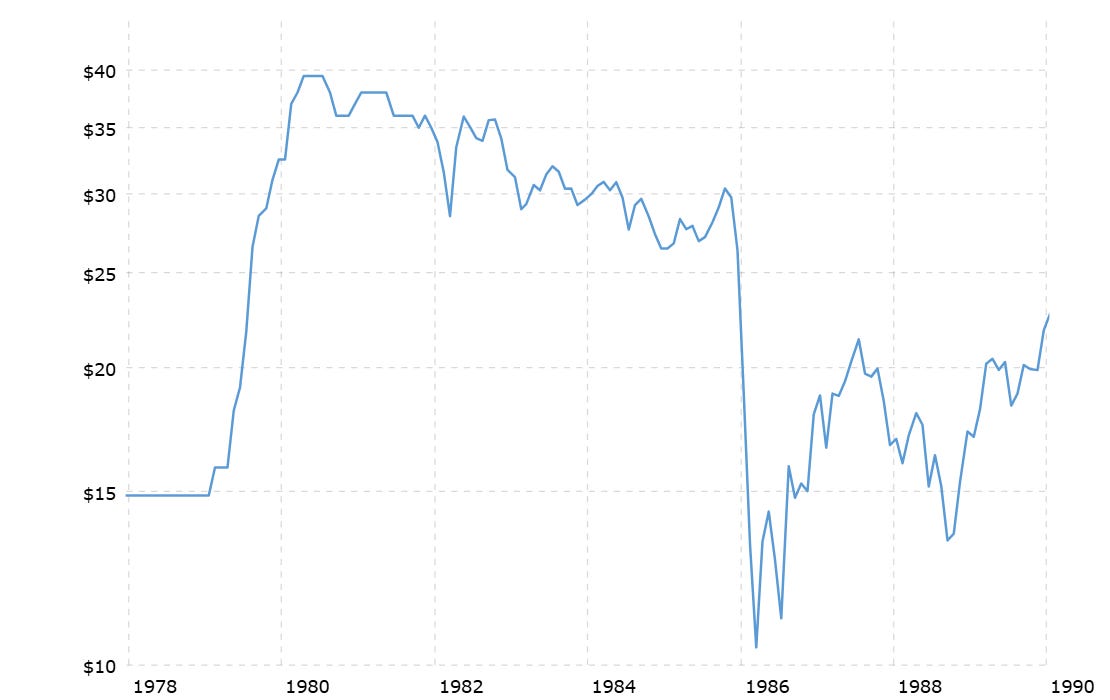

Between October 1985 and March 1986, the cost of a barrel of oil (WTI) fell by over 65%, following amongst other catalysts, Saudi Arabia increasing its daily oil production from 2 million barrels per day to 5 million barrels per day.

1980’s Oil Prices (WTI)

While housing prices in the rest of the U.S rose, in Texas they fell, as a period of over half a decade of a booming oil industry came to an end. It would take 8 years for Texan housing prices to recover to their previous highs, while in the broader U.S housing prices had risen by over 40%.

When the Great Recession hit in December 2007, Texas housing prices had risen by 74.7% since our 1985 point of divergence, with the broader U.S up by 195.9%.

While the median national household income had risen by 113.0% versus 95.8% in Texas, on balance this additional income was significantly outweighed by the significantly greater debt burden resulting from higher housing prices when the Great Recession came knocking.

Not long after the onset of the Global Financial Crisis, Texas once again took a sizable hit from its links to the oil industry, as the price of oil dropped by over 77% in a little over 6 months.

Yet despite Texas being a major epicentre for another energy sector downturn, it performed better than the national average when it came to both its labour market and home foreclosure rates.

A Unique Case

According to data from the Case Shiller U.S Housing Price Index, between the peak in housing prices at a national level in Q2 2006 and the trough in prices in Q4 2011, housing prices fell by 26.7%.

Keep reading with a 7-day free trial

Subscribe to Avid Commentator Report to keep reading this post and get 7 days of free access to the full post archives.