And Then Things Got Worse

The decade for housing since Joe Hockey's infamous comments

A little over a decade ago, then Treasurer Joe Hockey entered into the history book of infamous comments by stating:

“The starting point for a first home buyer is to get a good job that pays good money,”

“Then you can go to the bank and you can borrow money.” Hockey said.

Ironically Hockey would last just another 3 months in the job before being shown the door.

Hockey went on to state that:

“A lot of people would much rather have their homes go up in value rather than fall in value,”

Now here we stand over a decade later, this time the government is from Labor, but the commitment to higher home prices and ever higher prices being seen as a positive remains.

Which begs the question, how has housing affordability evolved over that time?

The Settings

When Hockey made his comments in June 2015, the benchmark discount owner occupier mortgage rate was 4.67%.

As of the latest data from the RBA, the current benchmark discount owner occupier mortgage rate is 6.05%.

In both instances greater discounts were on offer, so it’s at least apples with apples.

In keeping with the times we find ourselves in we will be assessing a scenario in which a household has the standard 20% deposit to put down and has the spare capital for stamp duty and other transaction costs.

But first some perspective on Australian housing affordability over a longer period of time.

Some History

While Australian homes have not been affordable for the median household in the adult lives of more than half of Australians, this wasn’t always the case.

As Australia closed the book on the 20th century, a household on a median household income could purchase the median home nationally with a 20% deposit and afford the repayments with 25% of their gross income.

With the mortgage consuming 30% of gross income, they could afford almost 60% of homes nationally.

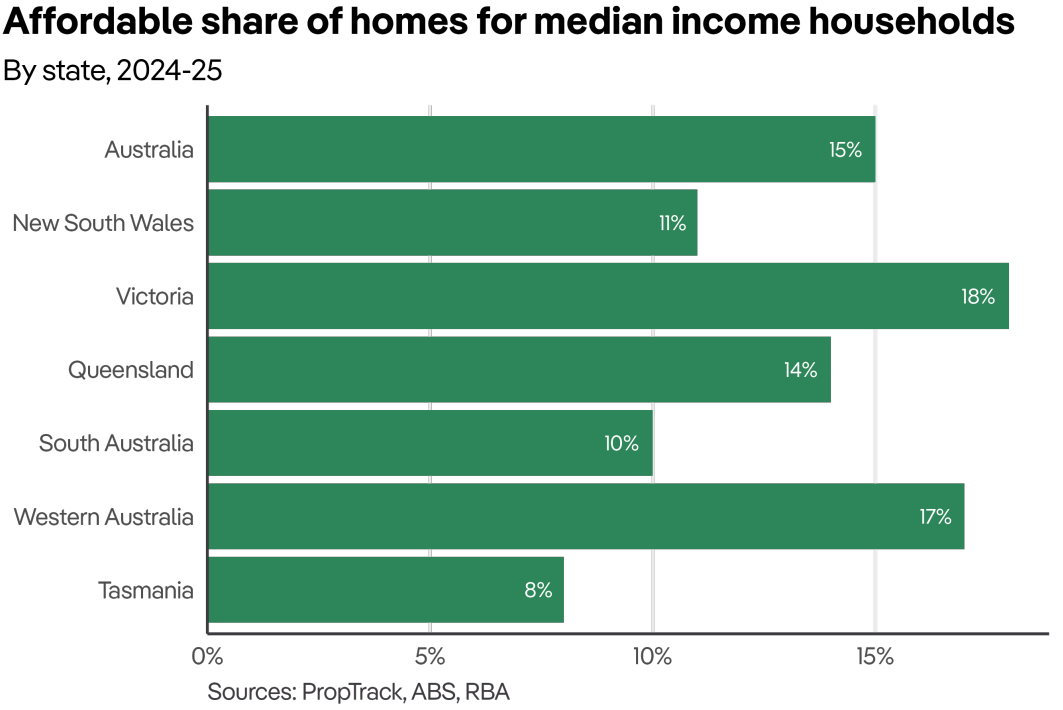

Today, just 15% of homes nationally are affordable for a median income household.

If we pick a random city that is currently pushing up toward a million dollar price tag, say Adelaide, it currently takes 53.6% of median household income for that city to afford a mortgage on a median house based on having cash for a 20% deposit and additional funds for stamp duty and other transaction costs.

If we go back to the final year of the 20th century, buying the median house in Adelaide took under 18% of average full time male earnings.

It is often said to me that it was never easy to buy a home, but I don’t think it’s too controversial to conclude that in relative terms it was far easier than it is today.

The Hard Numbers - A Trip Back In Time

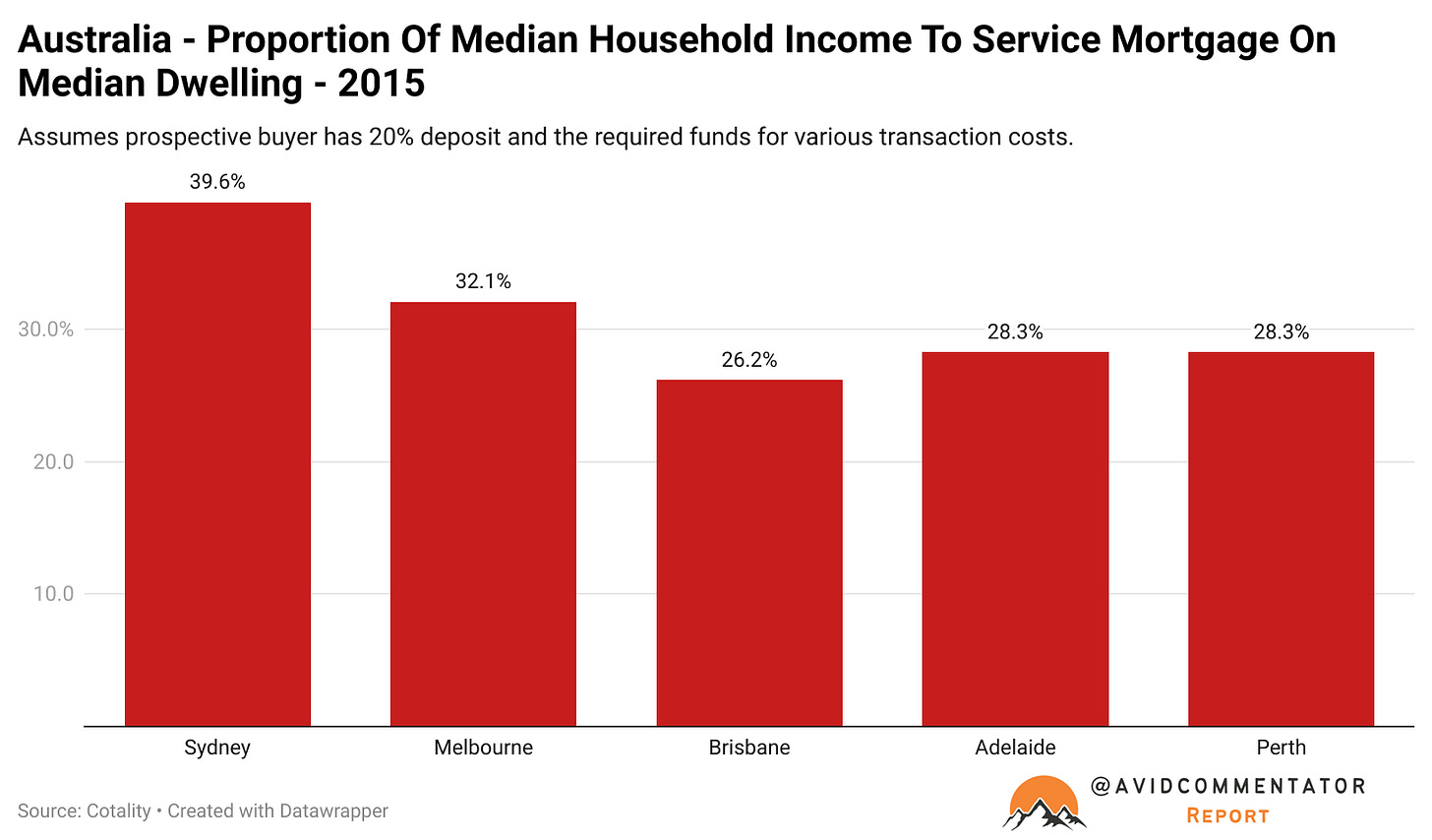

Back in 2015 when Hockey made his comments, servicing a mortgage on a median dwelling in the nations five largest capital cities consumed 30.9% of median household income.

The largest burden was held by Sydney, where it consumed 39.6% of median household income.

At the other end of the spectrum the lowest mortgage servicing burden relative to income was held by Brisbane, with 26.2% of median household income.

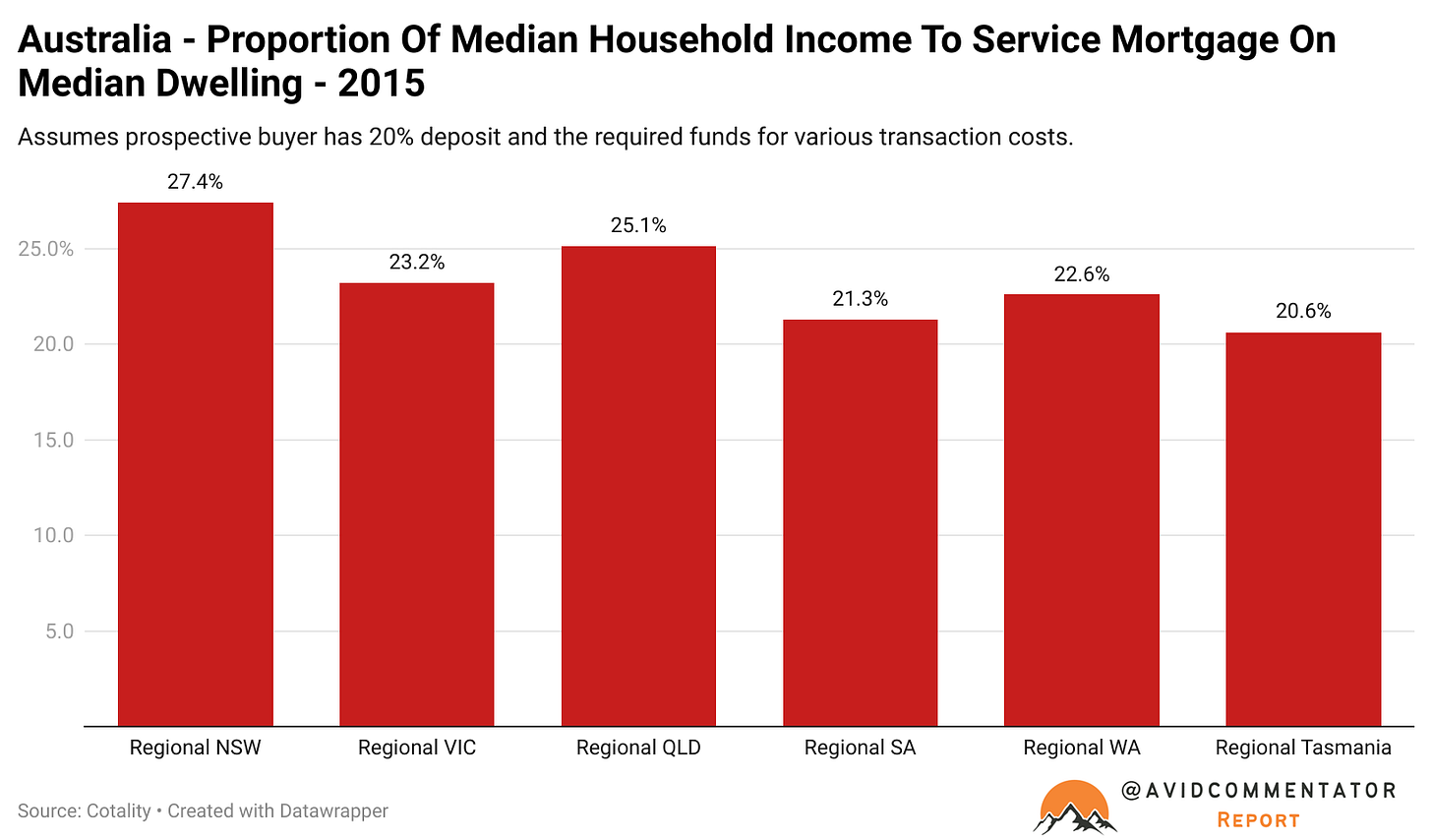

If we turn our attention to the regions things got significantly easier.

Of the three most populous states with the largest regional populations, NSW, Victoria and Queensland, regional NSW had the highest mortgage servicing burden at 27.4% of median household income, followed by regional Queensland with 25.1% and finally regional Victoria with 23.2%.

The Hard Numbers - A Deteriorating New Reality

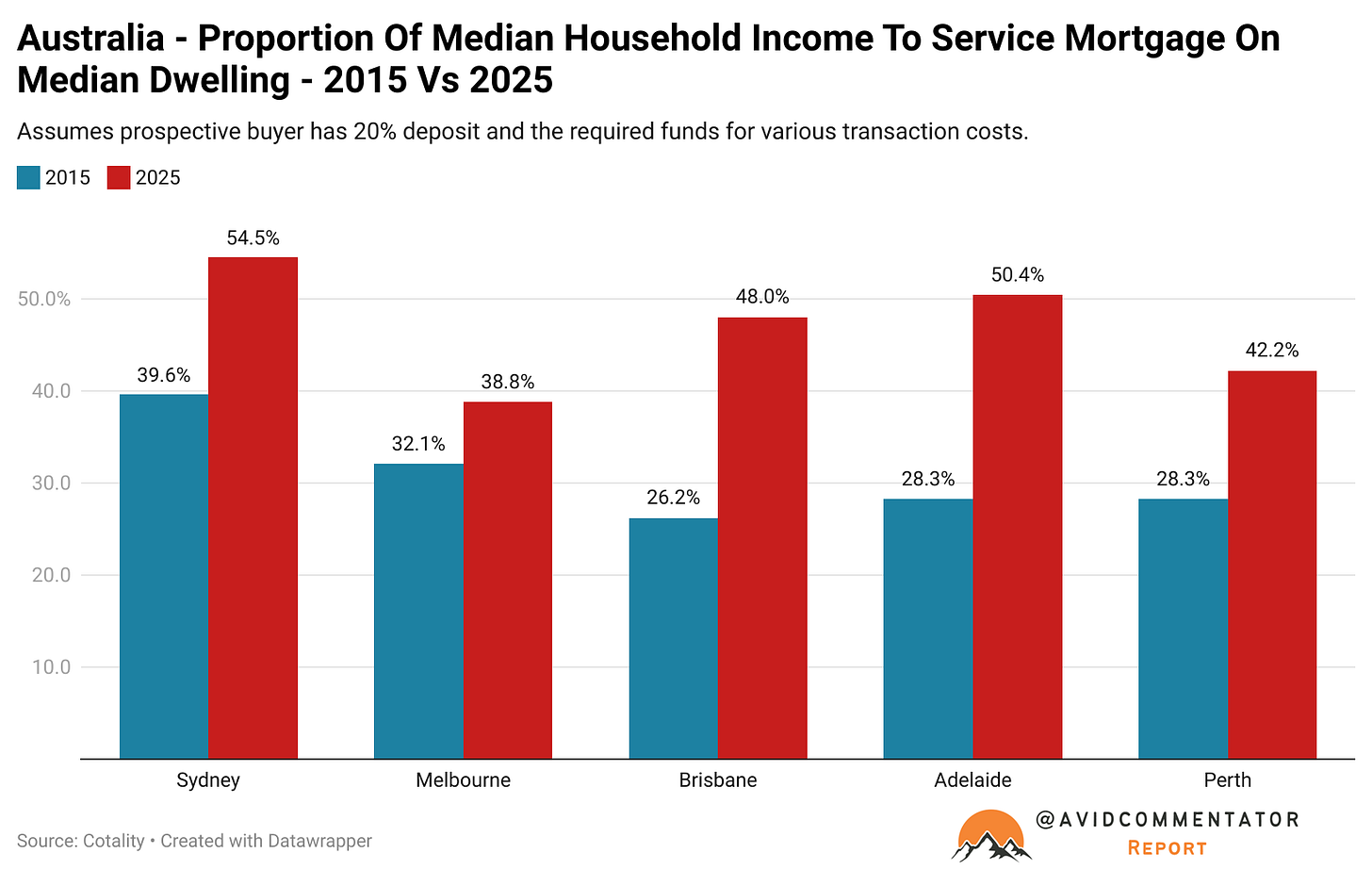

Across the five largest capitals each and every one saw a deterioration in housing affordability over the last decade.

The largest deterioration was seen in Adelaide, where a mortgage on the median dwelling now consumes 50.4% of median household income, compared to 28.3% in 2015, up by 22.1 percentage points.

The smallest was seen in Melbourne, where a mortgage on the median dwelling now consumes 38.8% of median household income, compared to 32.1% in 2015, up by 6.7 percentage points.

The largest mortgage burden relative to income continues to be held by Sydney, where servicing a mortgage on a median dwelling now consumes 54.5% of median household income, up from 39.6% in 2015.

The smallest mortgage burden is held by the aforementioned Melbourne, with 38.8% of household income being consumed.

Of all the deteriorations in relative affordability over the past decade across the country the largest occurred in regional NSW.

Today, servicing a mortgage on the median dwelling in regional NSW consumes 49.6% of median household income, up 22.2 percentage points since 2015.

Of all the markets assessed by Cotality, regional NSW now has the third largest mortgage burden in the country relative to incomes, behind only Adelaide and Sydney.

Unfortunately the news get’s worse, affordability has deteriorated so significantly across the entirety of regional Australia (excluding the Northern Territory), that the cost of servicing a mortgage in a regional area is today higher than it was to do so in the corresponding states capital city back in 2015.

The Takeaway

Back in 2015, it was already significantly more challenging to buy a home at a national level than it was back during the final era of broad based affordability in 1999.

But since then things have deteriorated dramatically further, with even homes at the median in regional areas now deeply unaffordable for a large majority of households who actually live there.

While the lack of mortgage defaults is often seen as proof positive that the ongoing increase in the mortgage burden is not a negative thing, the simple reality is households have less and less of their income to deploy into the consumer economy, dragging on economic growth and productivity.

With households now carrying larger and larger debts later on into life, a substantial portion of the current challenges are unfortunately baked in for decades to come.

Ultimately, to somewhat glibly borrow from former Treasurer Hockey’s rhetoric, you need to get a pretty damn good job to buy a the median house in much of the country today, because if you don’t it’s probably just not happening without some form of assistance or existing equity.

— If you would like to help support my work by making a one off donation that would be much appreciated, you can do so via Paypal here or via Buy me a coffee.

If you would like to support my work on an ongoing basis, you can do so by subscribing to my Substack or via Paypal here

Thank you for your readership.

Keep reading with a 7-day free trial

Subscribe to Avid Commentator Report to keep reading this post and get 7 days of free access to the full post archives.