Aussie Housing Prices Falling Faster Than U.S Housing Crash - A Data Driven Tale

Contrasting a historic crash with Australia in the here and now

Disclaimer: This is not financial advice and should not be considered as such. If you require personalized financial advice, please seek the services of a relevant professional.

In recent days there has been a great deal of speculation that Australian housing prices could bottom in the coming months. Most notably, housing price data provider Corelogic made headlines with speculation that it was possible that Sydney could bottom by the first quarter of next year.

This type of commentary has been coming thick and fast from property spruikers (vested interests) and some figures in the industry for quite some time now.

But let’s explore this possibility for the moment from a data driven perspective.

The Market In The Now

In the past few weeks there has been some commentary that the price falls we’ve seen so far have occurred at a relatively moderate rate. In order to assess this, we’ll be looking at Australian housing prices since interest rates began rising compared with price falls from the U.S housing crash from the onset of the global financial crisis recession.

Some of you may be thinking why choose this as a starting point? In short, to eliminate any claims of cherry picking data to make Australia’s falls look worse than they are, so this point was very deliberately chosen.

At this point in the U.S housing crash, prices had fallen by 3.65% from the time the U.S officially entered recession. Meanwhile, the 5 capital city average for Australia has fallen 5.6% since the start of May, which is when the RBA began raising interest rates.

Its worth noting that part of the reason why U.S falls are smaller than Australia’s is down to seasonality, but we’ll get to that in more detail shortly.

At this point prices in Sydney, Melbourne and the capital city aggregate are all falling faster than the U.S during its housing crash. While Brisbane’s performance remains slightly better than the U.S benchmark, if current trends continue it will soon fall below the trajectory of the historic U.S housing market.

Meanwhile, Adelaide and Perth both showed resilience for quite some time, but are now showing relatively minor price falls.

While the price falls so far could be described as orderly, with no real panic present in the market, they are not moderate at a capital city aggregate level, with prices falling at the most rapid rate in at least 40 years.

Seasonality And Housing Markets

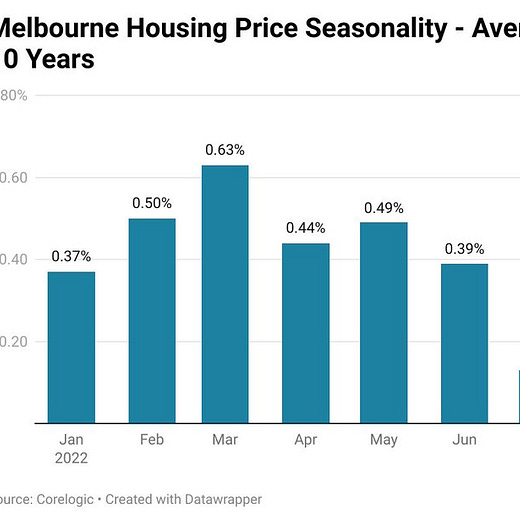

When it comes to housing markets, seasonality can be a major factor, even in what seems like the darkest moments for a market or an economy.

In April 2008, U.S housing price falls moderated to just 0.2% month on month, giving rise to ideas that the worst could be over. Naturally with hindsight, we know they weren’t.

Again and again seasonality drove more positive monthly data points for the U.S housing market even within the broader downtrend of its historic crash. In June 2009, April 2010 and May 2010, the U.S housing market at a national level recorded growth of 1.1% or more, on a month on month basis.

But in the end these moments of market strength driven by seasonal demand and market psychology were just that, moments.

Australian Market Seasonality

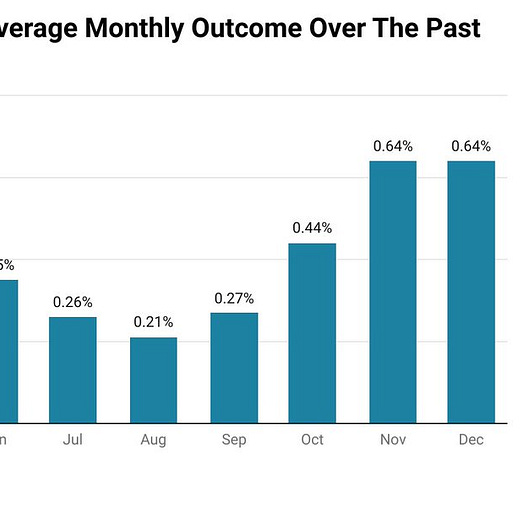

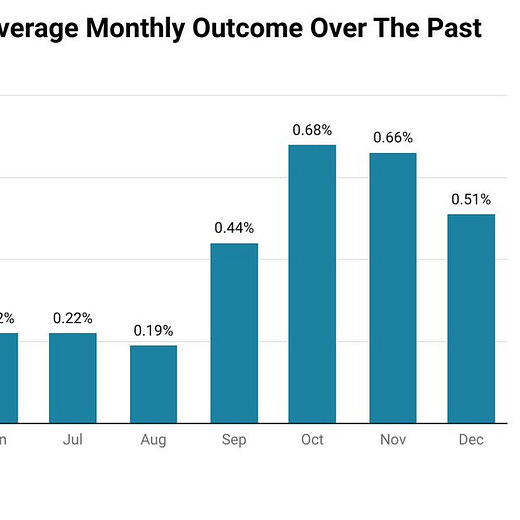

Like the U.S, Australia has its own unique market seasonality, with some months performing much more strongly than others. Since much of the commentary about prices bottoming is focused on Sydney, that will be the main focus today.

However, I will include charts of the seasonality for an additional four cities (the largest) in a tweet here due to the article being too long for email otherwise.

Over the past decade the strongest months for price growth in the Sydney market have been March, September and October.

It is here where one of the potential drivers of the recent mild moderation in Sydney housing price falls becomes clear. We have just emerged from winter and the absolute seasonal low for the performance of the Sydney market, with monthly outcomes historically improving by 0.65% in September vs July.

This time September improved by 0.41% when contrasted with its course in July.

While this is currently just a theory, the data suggests that this could be a driver of the recent moderation in price falls that have been grabbing headlines.

Falling New Listings

As I covered in an article this weekend for News.com.au, the volume of newly listed properties has continue to fall in recent weeks despite this historically being the time of year when they surge higher as the spring selling season goes into full swing.

When contrasted with the prior four years, only 2020 performs more poorly in terms of the number of newly listed properties in Australia’s capital cities on a rolling 28 day basis.

Its possible that this low volume of newly listed homes and the still relatively low level of overall stock levels may be contributing somewhat to moderating price falls in Sydney.

The Way Forward

While unexpected outcomes can never be ruled out when it comes to the Australian property market, the data we do have suggests that its too early to be calling a bottom in any market.

With the peak erosion of borrowing power still months away according to even the most optimistic estimates and roughly 8 months away according to market pricing for interest rate futures, the downward pressures on the housing market appear set to continue.

Given that this is Australia that we are talking about, all manner of silly intervention by the government, the RBA or APRA cannot be ruled out. But without some form of external intervention, its challenging to see how the market bottoms out as rapidly as is being suggested.

While data from overseas is hardly a one for one mirror of the Australian housing market, the data we do have from places like Canada and New Zealand suggests that there is still more downside ahead in the coming months.

Ultimately, the Australian market more broadly is heavily influenced by interest rates, credit growth and credit availability, and those drivers appear unlikely to turn in the markets favour in the immediate future without some sort of global meltdown.

— If you would like to help support my work by donating that would be much appreciated, you can do so via Paypal here or via Buy me a coffee. Regardless, thank you for your readership.

If you would like to support my work on an ongoing basis, you can do so here via Patreon or via Paypal here

You're a powerhouse Tarric. Excellent analysis. You don't find this quality of research, and realist commentary anywhere else. Keep up the good work!