Bank Of England Train Wreck Keeps The RBA Awake At Night

All Western central bankers face challenges, but the RBA faces another inflationary wave

In the long and storied history of central banks, there are many tales which have come to define how monetary policy approached. From the cautionary tale of former Fed Chairman Arthur Burns who saw inflation become entrenched on his watch, to the legend of Paul Volcker who finally brought inflation to heel with the highest interest rates in U.S history, central bank psychology and by extension their actions can be defined by narratives.

One of those narratives in more recent years was the almost universally prevalent theory that inflation was transitory and nothing to really worry about on a longer term time horizon. This narrative has arguably blown up no where more notably in the developed world than in Britain.

While other developed nations all have inflation problems with varying degrees of severity, it is Britain that has become the cautionary tale for central bankers in the current inflation cycle. Ironically, the Bank Of England (BOE) was actually the first central bank of the large developed economy’s to raise interest rates in December 2021.

But despite the BOE holding the early mover advantage, monetary policy was not tightened swiftly enough to prevent inflation becoming entrenched and a wage price spiral becoming a major driver of broader inflationary pressures. While energy and food price inflation were both exacerbated significantly by the war in Ukraine, the BOE failed to adapt their policy to the additional inflationary pressures that these factors and others would drive.

On Wednesday, figures were released that things had worsened further, with core inflation hitting a new 30 year high of 7.1%. But even prior to the reacceleration in core inflationary pressures in the last two months of data, core inflation had been bouncing between 5.8-6.5% for almost a year.

Following this disastrous result, the BOE shocked the market by raising interest rates 0.50% instead of the expected 0.25%. Amidst this hawkish recommitment to fighting inflation, financial markets are pricing in a terminal rate of around 6%, far above what was broadly viewed as necessary just a few months ago.

In short, the Bank Of England have made an absolute mess of things. With inflation now entrenched and a wage price spiral in place, the BOE now need to make some extremely tough and unenviable decisions. For central bankers around the globe the experience of the BOE is the stuff of nightmares, a scenario that to keeps them awake at night hoping that it won’t be replicated in their own backyard.

Lowe’s Nightmare

While all developed world central bankers remain in a difficult spot, RBA Governor Philip Lowe is amongst those facing one of the most challenging scenarios. Unlike Europe or the United States, Australia is yet to experience the full force of the inflationary shock stemming from rising household energy and rental costs.

Currently the rental component of the CPI is sitting at 4.9% year on year. This is well below the increases seen in asking rents recorded by private providers, some of whom have seen capital city rents rise by over 20%. While total overall rents are what feeds directly into the CPI, long term data shows that eventually the CPI ends up catching up with the asking rents seen in the data of private providers such as SQM Research or Corelogic.

Based on data from SQM Research, I estimate that the CPI is lagging behind by roughly 20 months. While aggregate capital city rental growth has moderated somewhat in recent months, it remains extremely high and year on year growth currently sits at between 11.7% and 18.6% depending on which private data provider is your preference.

During a recent Senate Estimates hearing, RBA Governor Philip Lowe shared the RBA’s estimate that the CPI rental component would rise by around 10% and that "Rent growth is going to stay high for quite a long time,".

Amidst reports that the Australian Energy Regulator and Victorian Essential Services Commission has confirmed that electricity prices will rise by between 20% and 25% from July 1st, its clear that there are inflationary pressures that are very much baked into the CPI.

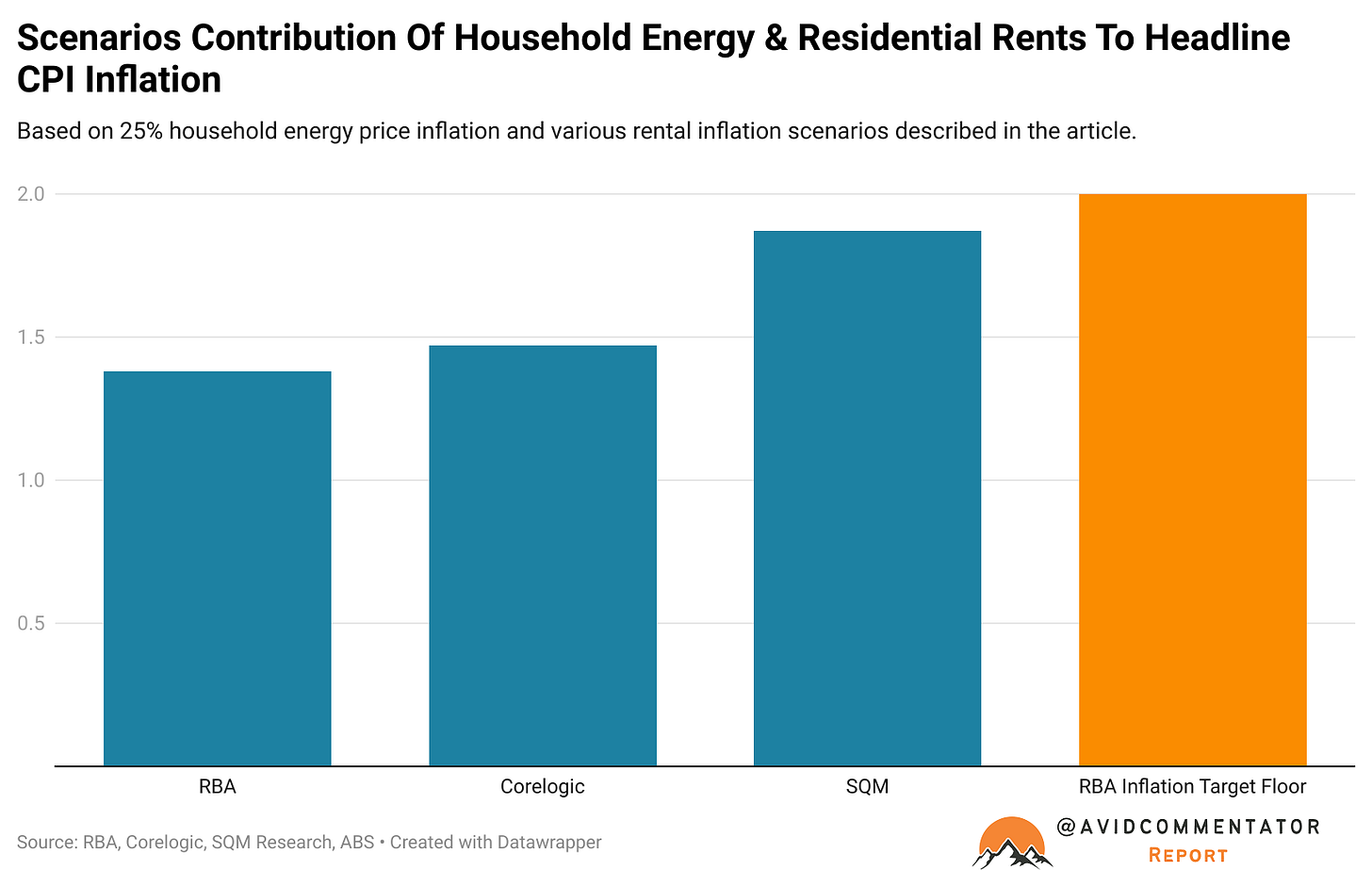

To explore this in a bit more detail, I put together three scenarios to measure the impact of household energy and rental price inflation on the broader CPI. To put these numbers into a bit of perspective, these CPI components make up 8.95% of the overall CPI basked. In each of the scenarios household energy costs rise by 25%, with the variable being the level of rental price inflation.

Household Energy And Rental Price Inflation - Total Contribution To CPI

RBA scenario (10% rental inflation) - 1.38%

Corelogic scenario (11.7% rental inflation) - 1.47%

SQM scenario (18.6% rental inflation) - 1.87%

The Outlook

As you can see even in the more optimistic scenario almost 70% of the RBA’s 2% inflation target floor is consumed by these items that make up less than 9% of the overall CPI basket.

In order to put these numbers into a broader historical context, the chart below is of inflation since 2012, but with the rental and household energy CPI components replaced with those of the three scenarios. Even during what was historically periods of lower than target inflation, the CPI remains well above the 2% RBA target floor and frequently spent time above the top end of the RBA’s 3% inflation target.

This illustrates how challenging it is likely to be to get inflation back under control on a relatively short timeline. Its worth noting that even during the global financial crisis it was 21 months after the collapse of Lehman Brothers before the RBA’s preferred inflation metric, the trimmed mean returned to within the RBA’s inflation target range.

Amidst this backdrop of a baked in inflationary pressures that most other Western central banks now have their rear-view mirror, the RBA and its Governor Phil Lowe have to confront the possibility that Australia may follow the U.K into a challenging period of entrenched inflation.

Brief note: After recent messages of support and pledges to pay a monthly subscription, Substack subscriptions have been turned on at $10 AUD per month and $100 AUD per year. All content will remain free, but if folks want to choose to support my content in this way they can and that would be greatly appreciated.

— If you would like to help support my work by making a one off donation that would be much appreciated, you can do so via Paypal here or via Buy me a coffee. Regardless, thank you for your readership.

If you would like to support my work on an ongoing basis, you can do so here via Patreon or via Paypal here