Burnout Economics And Aussie Household Consumption By Age Demo

Australia's Young Fall Further Behind, Yet Aggregate Spending Rises

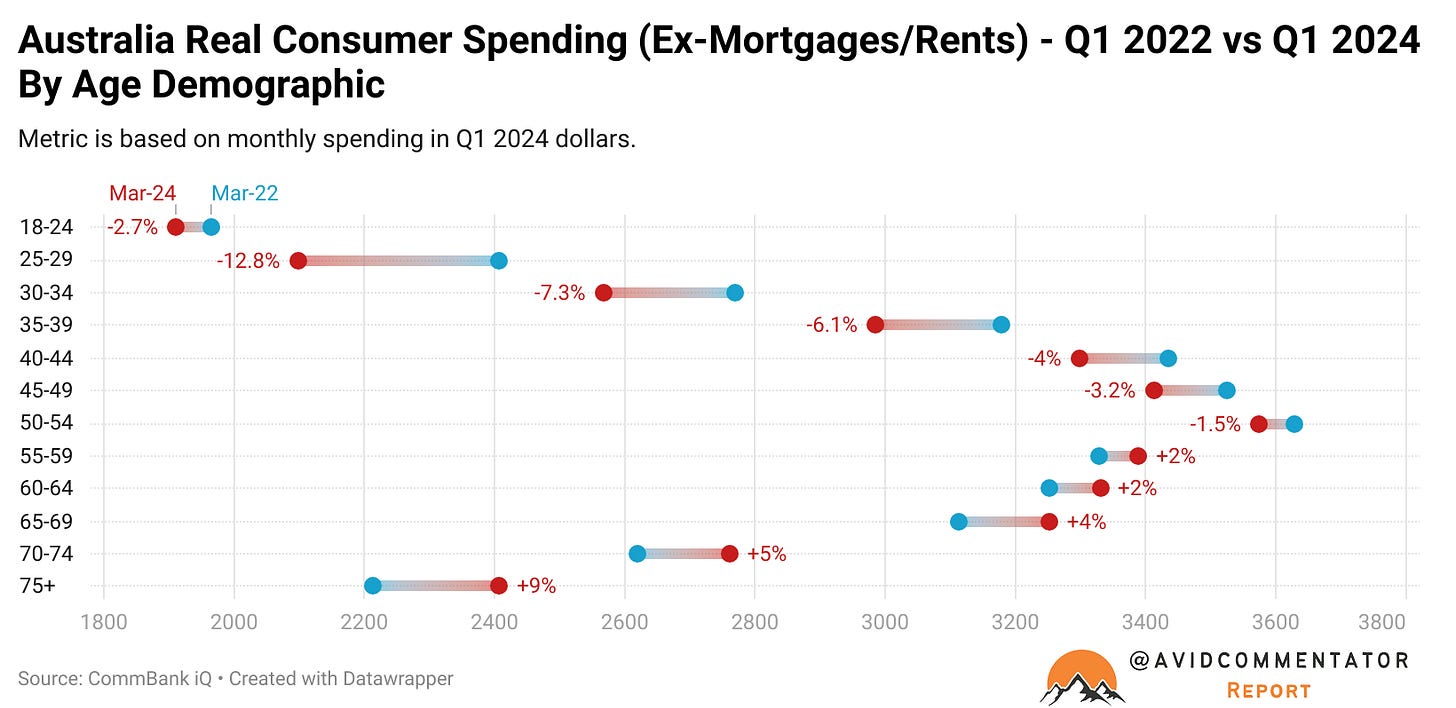

In recent years, the Commonwealth Bank (CBA) has frequently made headlines with the release of its consumer spending data broken down by age demographic. With each release it whipped up debate, as it continued to illustrate the spending of older demographics accelerating away and the spending of younger people who at times saw their spending fall outright in nominal terms.

With the release of the latest data and with a bit of help, I can shed some light on the various aspects of consumer spending including spending by age demographic and how much spending has grown or contracted in real terms.

Before we get into the figure’s its worth quantifying exactly what this metric measures. It covers consumer spending excluding residential rents and mortgage repayments. Its worth noting that while this is far from perfect for capturing the full breadth of the spending of households, it does give us about as much insight as is available for the trends in household spending on consumer goods and services.

It is at the very least an apples with apples comparison of consumer spending over the last two years.

The Impact On Aggregate Demand

If we assume that the individual age demographics remained the same size as they were in 2022, since we lack a concrete ABS estimate for 2023 in its entirety and beyond, real total aggregate annualized consumer spending would have fallen by $12.3 billion (a decline of 1.7%).

All age demographics under 55 saw their real consumption reduced, with those aged 25-29 seeing the largest fall of 12.8% or $6.9 billion in annualized real spending over the last two years. Given the size of the decline, its entirely possible that this is the largest sustained drop in real consumer spending for this vital demographic since the Great Depression.

At the other end of the spectrum, the largest increase in spending was seen in the over 75 age demographic, who saw their real spending rise by $4.7 billion.

While the 55 and over demographic cumulatively saw their annualized real consumer spending rise by $11.4 billion, this was more than counteracted by the falls in the spending of those aged 18 to 54, who saw their spending fall by over $23.7 billion.

In a vacuum, additional real consumer spending of $11.4 billion stemming from older demographics played a significant role in supporting inflationary pressures, particularly in industries where they have come to represent the lions share of recent consumption growth such as holiday travel and eating out.

The Great Debate - Boomers Vs Everyone Else

In the last two years, the impact of rising interest rates and rocketing rents has turned household consumption patterns by age completely on their head.

Those 75 and over now spend 14.7% more per month than those aged 25-29, despite the younger demographic spending 8.8% more than those 75 and over back in March 2022.

30 to 34 year old’s are now outspent by 70-74 year old’s by 7.6%, despite spending 5.4% more than the older cohort two years prior.

I could go on, but the chart below does a pretty good job speaking for itself.

Under 40’s in particular have been replaced as the growth engine of consumer consumption by those aged 65 and over, taking over half a century of household spending norms tearing them up and lighting them on fire.

It’s here a key point needs to be made. This is likely just the beginning of the shift toward an economy that will become increasingly reliant on the spending of affluent older demographics.

The part of the Australian economic system that was intended to provide over 60s and retirees with a far greater quality of life and incomes in their old age has worked out pretty much as intended. Every year, each new member of the superannuation preservation age club (the age super can be withdrawn tax free) comes to the party with an additional year of compulsory super and more time for that balance to be compounded.

The issue is the rest of the economy stopped working for younger demographics a long while ago. Even before the current large falls in household consumption, the real spending of 15-24 year old’s and 25-34 year old’s, had already flatlined, as the burden of saving for a home deposit and near non-existent real wages growth combined in a perfect storm.

Stepping Back For Some Perspective

Despite the sizable expansion in the real spending of over 55s ($11.4 billion) and the norms of consumer consumption patterns being thrown out of the window, when put into perspective with the more than $23 billion fall in real spending for under 55s, in a vacuum its impact is more than cancelled out based on a static population size.

When compared with the aggregate growth in household consumption growth driven by a rising working age population over the two years assessed by CBA, it pales in comparison.

In the two years to March 2024, the Australian population has grown by approximately 1.25 million or 4.8% (based on ABS population clock figures). Based on the ABS labour force figures, the working age population (those aged 15 years or older), has grown by 1,144,000 or 5.4% since March 2022.

If we assume an average level of working age population consumer consumption as assessed by CBA for these additional 1.14 million people, $42.0 billion in spending has been added into the economy between March 2022 and March 2024 on an annualized basis, far eclipsing the $12.3 billion fall in aggregate spending by the existing populace.

While reasonably high levels of working age population growth are not uncommon during Australian monetary policy tightening cycles, this one is by far the largest in per capita terms since records began in the late 1970s.

For example, the working age population in the two years proceeding the 1990-1991 recession grew by 3.6%. However, if we were to assume that every single migrant during those two years was of working age, they accounted for a little over half of that growth. In reality a majority of the growth came from existing Australians turning 15 and becoming counted in the working age population.

Given that 15-17 year olds don’t generally have a whole lot of money to spend relative to a working adult, their impact on overall aggregate consumer demand is limited to say the least. In the present, in the two years to March 2024, the working age population has grown by 5.4% (2 years to May 2024, 5.88%)

A Uniquely Challenging Position

By pursuing a strategy of Burnout Economics, in this instance through record high migration, the Albanese government has managed to create a set of circumstances where renters and mortgage holders are both taking historically large hits to their household budgets and economic indicators from real retail sales per capita to real household disposable income per capita are reflecting that.

Despite the large rise in rates, the data suggests that the largest hit to consumer spending has been taken by demographics who are more likely to be renters.

After enduring such a sizable downturn in per capita household consumption outcomes, one would expect inflation to largely be tamed and for the business cycle to be drawing to a close.

But it isn’t.

Inflation remains entrenched and the business cycle is still holding on, leaving Australia in the challenging position that another leg down in household outcomes amidst a recession is well and truly a possibility.

Ultimately, we may be seeing only the beginning of a further divergence between the consumer spending of different age demographics and the elephant in the room that is the Albanese government pursuing its own brand of Burnout Economics.

— If you would like to help support my work by making a one off contribution that would be much appreciated, you can do so via Paypal here or via Buy me a coffee.

If you would like to support my work on an ongoing basis, you can do so by subscribing to my paid Substack

It's pretty easy to work out. The present system has been engineer to benefit those holding assets. Until this paradigm is fundamentally challenged, wealth is only going to accumulate upwards. The middle class thinking that their home price rising by bank created money bubble was wealth building have been lead down the garden path. They have basically consigned their kids back into being mere working class.

Agreed: The burden of saving for a home deposit and near non-existent real wages growth combined in a perfect storm.

Naturally, if housing is becoming prohibitively expensive expect that people will need to shave their consumption to put a roof over their head or pay rent.

But immigrants are not the source of the problem. Remember that when immigration came to a halt during the pandemic house price inflation took off. Now, the people who reaping a 50cents in the dollar tax deduction as they write off the expenses attached to owning more houses, including the marginally increased interest rates, have got the bit between their teeth, and they are going for it. Perth house prices up 22% in the year to May 2024.

The home building industry is stuffed by over-regulation that binds the would be 'owner builder' hand and foot.

Add in the desire of developers to meet the demand for four bedroom homes by NIMBYs, who are chasing capital gain. Result, no four by twos.