Can The Aussie Economy Stand On Its Own?

The government jobs printer has jammed, for now

With the end of financial year coming up, the subscriber drive at Burnout Economics is on. If you become a paid subscriber by the end of the financial year, it may be tax deductible depending on your individual circumstances.

Coming up for paid subscribers, we’ll got the latest breakdown of consumer spending by age demographic which held some interesting revelations and also a deep dive on the proportion of GDP driven by government. It will break it down by the proportion dedicated to day to day spending, as well as investment, while also looking at the figures by which party is in power, along with a whole lot more.

With the release of the latest labour account figures, it was revealed that the total number of filled jobs in the economy contracted for the first time since the March quarter of 2021.

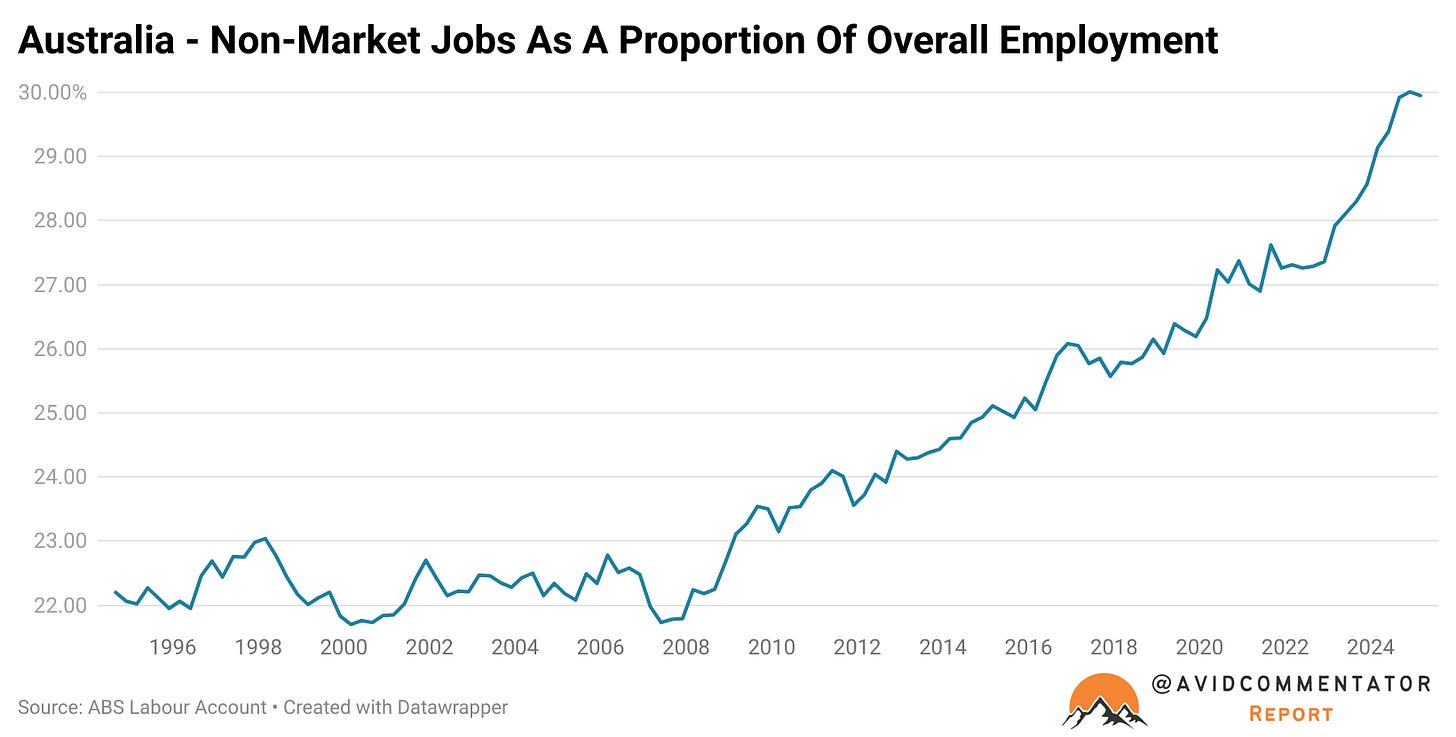

In the years since the Global Financial Crisis and in particular since the onset of the pandemic, the Australian economy has become heavily reliant on non-market jobs growth to drive overall employment growth. Non-market jobs are defined by the ABS as those in Public Administration and Safety, Education and Healthcare and Social Assistance.

In short, effectively employment in sectors of the economy that overwhelmingly taxpayer funded. This has come to be known in some circles as the taxpayer funded jobs printer.

Prior to the GFC, the proportion of total employment in these roles bounced around in a tight range of approximately 22-23% of total jobs. Since then it has undergone a meteoric rise and now sits at 30% of total employment, by far the largest relative rise in the Anglosphere. I have covered this in detail previously here if you would like to take a look.

But this latest quarter of data brought with it a set of circumstances not seen since the dark days of the pandemic, the ranks of non-market jobs holders contracted, with employment in this sector of the economy falling by 11,800 jobs.

To put this into perspective, since that last contraction in Q1 2021, the non-market sector has created an average of 66,300 jobs each quarter or 265,200 per year on an annualised basis. The ironic thing is if you remove 2021 and 2022 from the equation due to the volatility in employment driven by the pandemic and then the rehiring of workers, the average level of non-market employment growth rises, not falls.

Across the 2023 and 2024 calendar years, an average of 81,000 non-market jobs were added or 324,100 on an annualized basis.

A Broader View

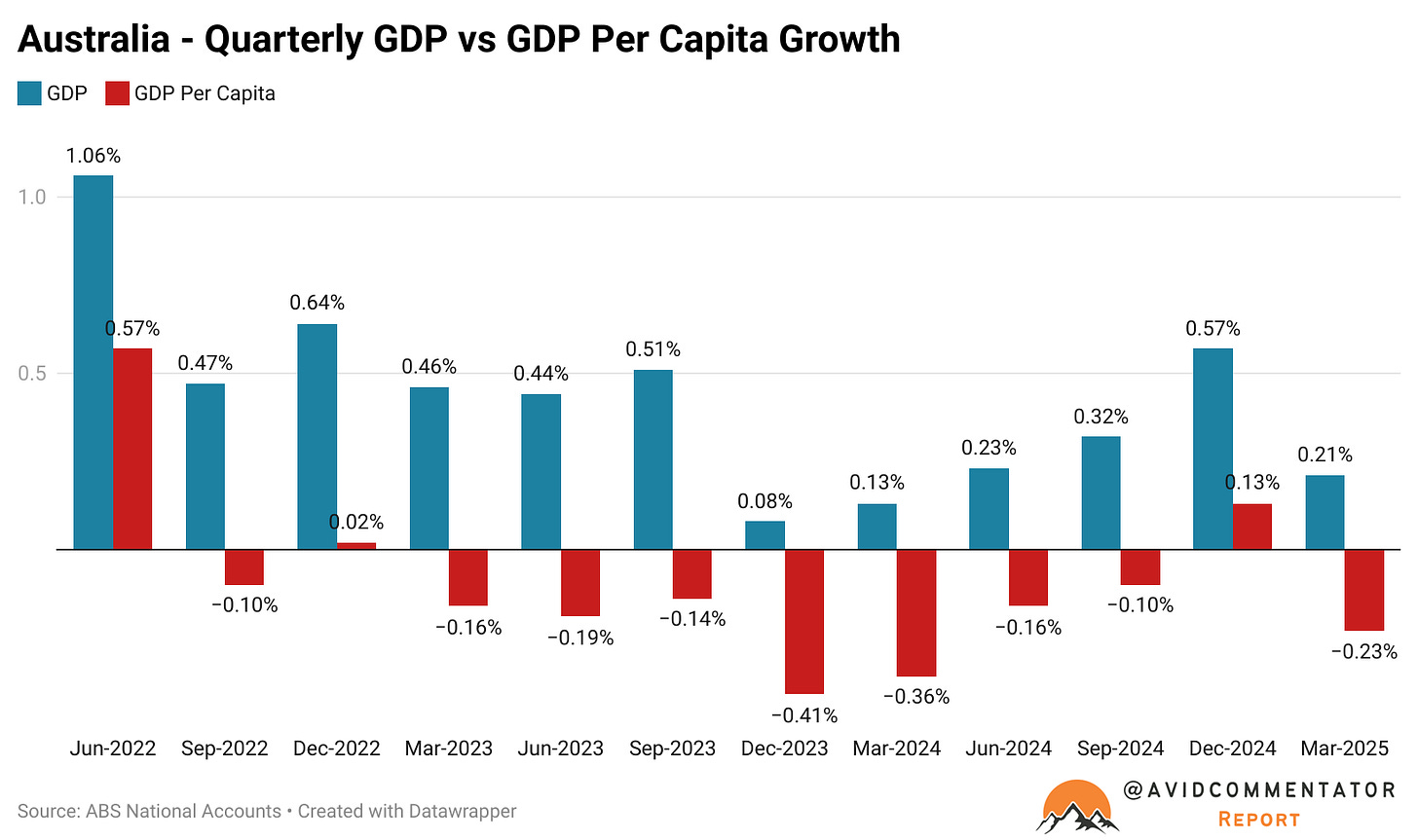

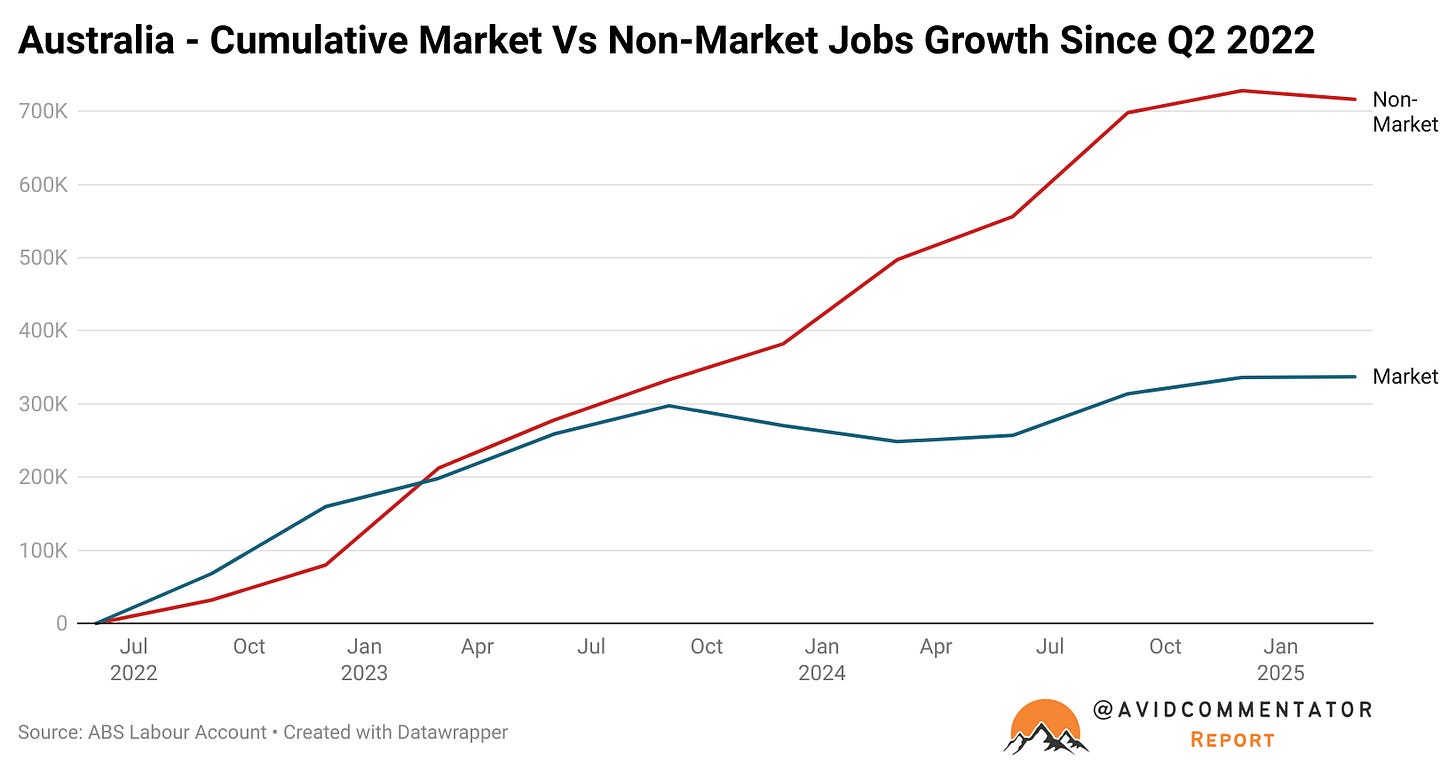

For a moment let’s just take a step back and assess where the labour market is at more broadly, we’ll do this from two points, from Q2 2022, which coincides with the election of the Albanese government and the last truly robust quarter of headline and per capita GDP growth and from the September quarter of 2023.

Since the June quarter of 2022, the economy has added a record 1.05 million new jobs. Of that total 716,300 are in non-market roles and 337,100 are in market roles. This leaves the non-market sector with a total share of employment growth of 68.0% across this period.

While this figure is not unprecedented, the only time it has been achieved outside of the pandemic was during the slowdown in employment growth during the GFC. A technical recession may have been avoided largely as a result of high levels of migration, despite a per capita recession being noted by Treasury, but jobs growth as measured by the Labour Account slowed to standstill.

If we shift our point of reference to Q3 2023, which marks roughly when strong nominal market based jobs growth drew to a close, an even more concerning picture emerges. Since then the economy has created 383,300 non-market jobs and just 39,700 market based roles.

In the last 6 months of data things have slowed further still, just 41,700 jobs have been created, with 18,300 in non-market roles and 23,400 in market jobs.

A Concerning Imbalance

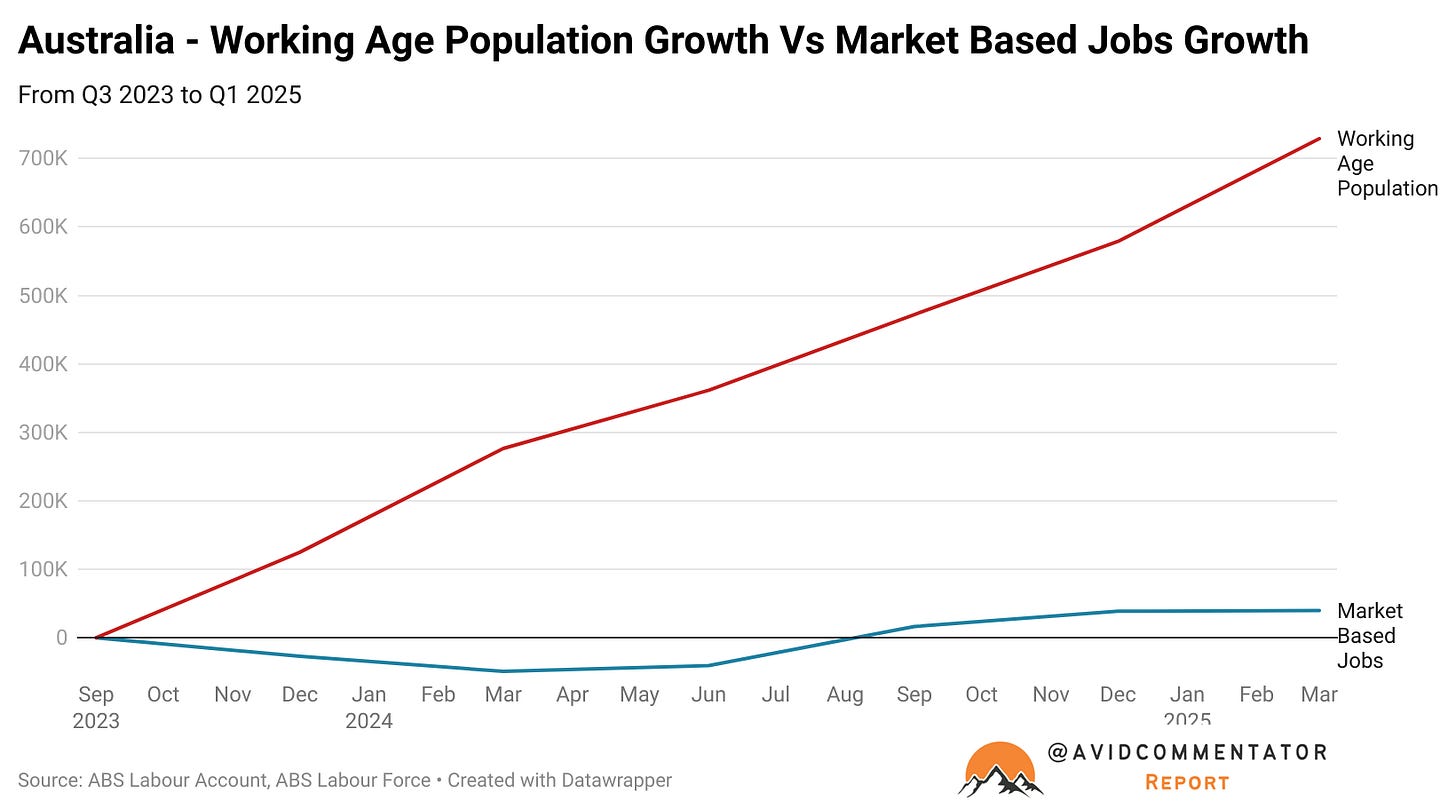

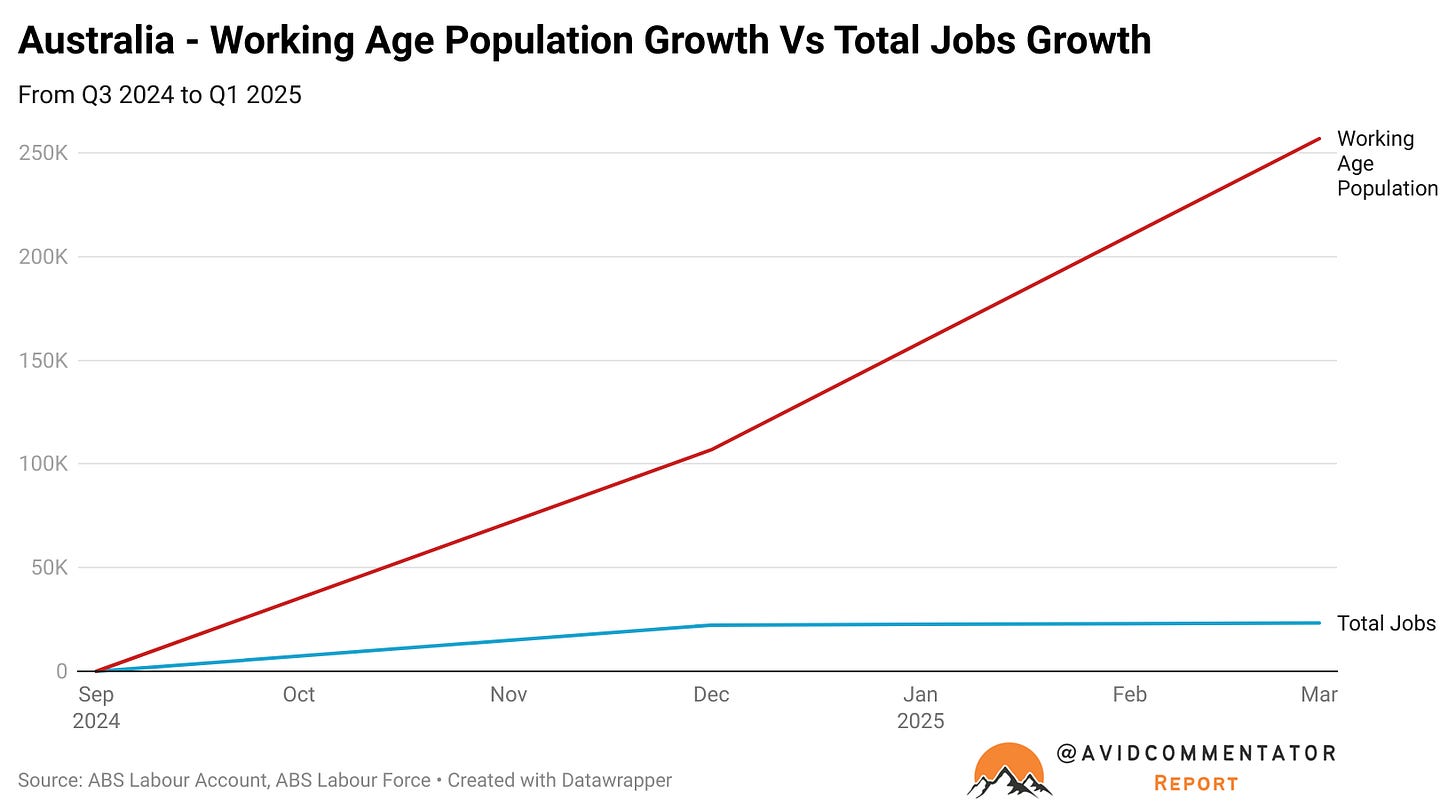

Despite the dramatic slowing of broader jobs growth in the last two quarters and market based jobs growth since Q3 2023, the growth in the working age population has remained extremely high.

Between Q3 2023 and Q1 2025, the total number of market based jobs rose by 39,700, while the working age population grew by 728,900.

If we once again go more recent and focus on the last 6 months, total jobs growth across both market and non-market sectors comes to 23,400 jobs, while the total working age population has risen by 256,800.

If the trend seen over the last 6 months continues then it will be just a matter of time before significant rises in unemployment begin to be seen in the ABS Labour Force figures.

But that is a very big if. So far the market based sectors of the economy have failed to reignite sufficient levels of jobs growth as non-market jobs growth pulls back.

The Winds Of Change?

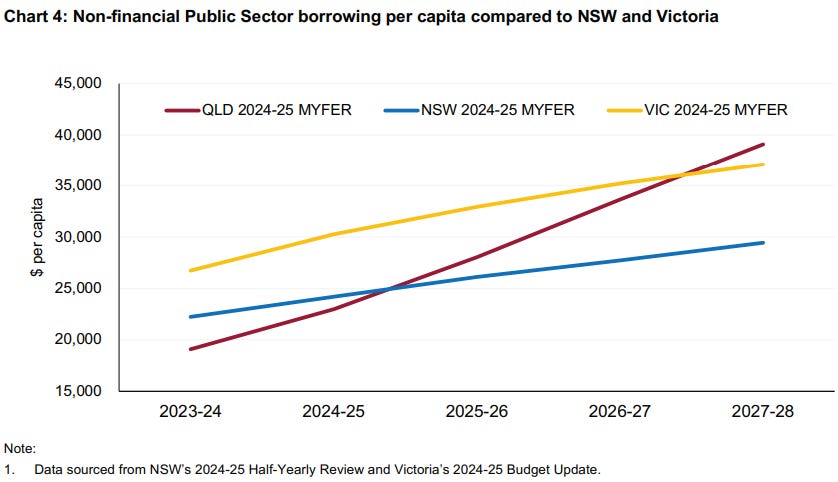

The big question going forward, is this the beginning of a sustained period of subdued non-market jobs growth as the Queensland and Victorian governments in particular attempt to cut costs to get their state’s back on a more sustainable fiscal path.

While federally funded employment through mechanisms such as the NDIS is expected to continue to grow significantly in net terms every year across the scope of the forward estimates, the states and local councils are increasingly facing significantly more challenging times financially.

Whether this outcome is a temporary blip or something more serious and protracted is unclear. After all the federal government and the states theoretically have plenty of scope to expand their debt loads at least for a time, even Victoria. While this would arguably be an unwise decision to pursue for this reason, having an economy become reliant on taxpayer funded employment growth in the first place suggests that this would not be a surprising outcome.

If the pullback seen in non-market jobs growth seen over the last 6 months is sustained, the market based sectors of the economy have a chance to once again become the primary engine of employment growth.

Whether it will be successful remains to be seen, but one can’t help but think that if it fails, the taxpayer funded jobs printer will see a resurgence in usage to at least some degree.

— If you would like to help support my work by making a one off donation that would be much appreciated, you can do so via Paypal here or via Buy me a coffee.

If you would like to support my work on an ongoing basis, you can do so by subscribing to my Substack or via Paypal here

Thank you for your readership.

If you were to change "Non Market Jobs and Market Jobs" to Non Productive Jobs and Productive Jobs.......