Healthcare, U.S CPI Distortions & Markets To The Moon

Not all was as it seemed with the October CPI report which sent markets rocketing

In the last 24 hours the latest U.S CPI inflation report has set off a great deal of debate and the strongest rally in U.S stocks since April 2020. It came in significantly lower than expected on all metrics, core, headline, month on month and year on year.

However, there were major distortions in the print and a factor that could keep downward pressure on headline and core inflation for quite some time to come.

October CPI:

Headline (MoM): +0.4% vs +0.6% EST

Headline (YoY): +7.7% vs +7.9% EST

Core (MoM): +0.3% vs +0.5% EST

Core (YoY): +6.3% vs 6.5% EST

A series of significant misses to be sure, but lets get into the distortions. For today’s purposes we’ll be focusing on Core CPI.

Medical Care CPI Is Highly Distorted

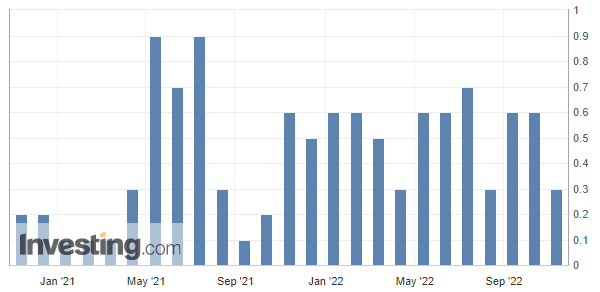

The Medical Care component of the CPI had its largest month on month fall in 50 years, due to a distortion in how healthcare costs are measured by the CPI.

The BLS uses a “retained earnings method” to estimate price changes, so once a year or so the index is adjusted. If you would like to explore this rather shall we say, different adjustment in greater detail, the Bureau of Labor Statistics explains it here.

Under more normal circumstances the adjustment is a bit jarring, but is generally not an overly challenging factor to come to terms with.

Not this time.

In October’s CPI report health insurance costs plummeted, leaving the overall Medical Care component of the CPI down 0.6% MoM.

This single factor dragged the core CPI down by 0.053% MoM, which doesn’t sound like a lot, but it is significant. If the healthcare component of the CPI came in at where it averaged over the prior 6 months to October’s report, core inflation would have been 0.11% higher, at 0.41%.

Before moving on, its worth noting that twice before in 2022 alone Core CPI printed a 0.3% MoM figure, prompting calls that inflation would soon be coming down.

A Major Drag - Used Cars

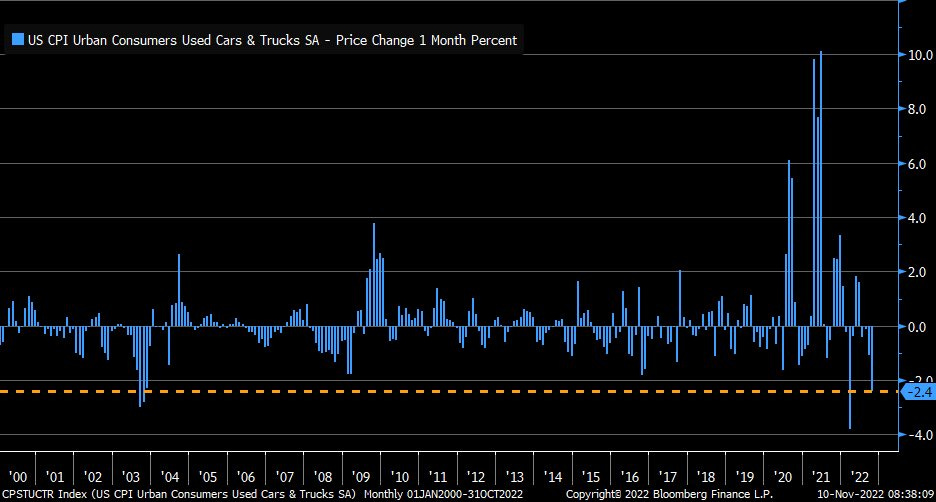

In this month’s CPI, the used cars component fell by 2.6%, its second largest fall since 2003. While the magnitude of the fall may have surprised some, the falls in used car prices have very much been telegraphed by large falls in indices of private providers.

This is a factor I have explored extensively recently, looking into inflationary scenarios in which used car prices mean reverted in inflation adjusted and non-inflation adjusted terms to pre-Covid levels.

In this month’s Core CPI, used cars subtracted 0.126% off the month on month figure and is likely to continue to provide a similar drag on inflation, until whatever mean reversion is in store has sorted itself out over the next 9-18 months.

While this factor will keep downward pressure on both MoM and YoY inflation figures for the immediately foreseeable future, its worth noting that it will also flatter figures going forward.

Eventually this headwind pushing back against rising inflation will come to an end and it may lull observers and policy makers into a false sense of security.

An Ironic If Slightly Silly Twist

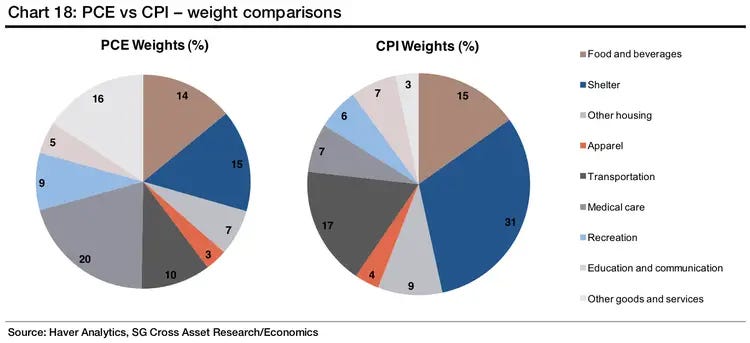

As the market continues to revel in what it perceives as an environment of weakening inflationary pressures, the funny thing is Personal Consumption Expenditure (PCE), aka the Fed’s preferred inflation gauge measures healthcare inflation in a completely different way.

It doesn’t follow the same convoluted mechanism of quantifying healthcare inflation, instead measuring healthcare price pressures in a much more normal way.

So despite the market rallying on this distortion, the Fed’s preferred inflation gauge may produce a very different result to this month’s CPI when its released on the 1st of December.

The weights are also very different, with medical care by far the largest component. Where as in the CPI the largest component by far is shelter and medical care is a distant 6th in the pecking order.

This is a key factor to keep in mind going forward. When rental inflation does begin to come off the boil, we could see the core CPI come down accordingly in the months that follow. However, in terms of Core PCE (PCE ex-food and energy), if healthcare costs take off we could see the high inflation baton passed to another sector to run with.

Putting It All Together

Despite the highly distorted nature of the report and the growing importance of the used car component to the downside story, a stock market looking for a reason to rally found one.

Ultimately, this report is unlikely to affect the path the Fed is on significantly, if anything the rally that the report drove is arguably far more likely to prompt a hawkish response from Jerome Powell as financial conditions continue to loosen.

There is still one more CPI report coming on December 13th and the November Payrolls report on December 2nd, as well as the Fed’s preferred inflation metric, Core PCE on December 1st.

In summation, I would approach this CPI print with caution given the distortions that were present in it. However, given the markets desire for a rally its equally worth treading carefully, in the knowledge that not everyone will approach the data with eyes open to explore the nuts and bolts of what is actually happening.

— If you would like to help support my work by donating that would be much appreciated, you can do so via Paypal here or via Buy me a coffee. Regardless, thank you for your readership.

If you would like to support my work on an ongoing basis, you can do so here via Patreon or via Paypal here