Ideal World - How Long For Affordable Aussie Housing?

Cyberpunk 2077 would be long in the past for one Aussie city to reach affordability.

With the end of financial year coming up, the subscriber drive at Burnout Economics is on. If you subscribe by the end of the financial year, it may be tax deductible depending on your individual circumstances.

Coming up next week we’ll be doing a deep dive on the latest market vs non-market jobs growth figures.

At the recent election the issue of housing was often cited as one of the top areas of concern for voters, despite the near policy void on proposals by the Albanese government or the Dutton opposition that would actually sustainably increase home ownership rates.

But what was made abundantly clear by the leadership of the Coalition and the Labor party, they both want higher housing prices. Albanese Government Housing Minister Clare O’Neil stated the government wasn’t interested in the market behaving like a market and that number must go up late last year in an interview with ABC Radio.

More recently this was echoed by former Opposition Leader Peter Dutton, who made it clear that the Coalition wants “steady” rises in housing prices. When I asked the Opposition Leaders office to clarify what “steady rises” in housing price their response was:

“We don’t want to see house prices go backwards—because if they do, it’s everyday Australians with mortgages who suffer.”

One solution put forward to the housing affordability question is the idea that housing price growth below the rate of wages growth would eventually solve the issue.

This was the view expressed by former Shadow Housing Minister Michael Sukkar in a recent interview with ABC Radio.

Sukkar told ABC Radio National that he wanted “to see house prices steadily increase”.

“And ideally you’d like to see wages increase more quickly (than house prices),” he added.

Others have suggested that a protracted period of flat prices would address the problem.

So for the sake of argument let’s imagine that these scenarios were magically possible and that no politician concerned about the inevitable backlash from vested interests tried to intervene to push housing prices higher…..like they are right now.

In order to gain some perspective on the issue we’ll be examining three different scenarios, all of which will break down the evolution of affordability by individual capital city, as well as a regional and national average.

Scenario 1 - The Status Quo

This scenario is effectively a rerun of the last 25 years, with the same rates of compounded average wage growth (3.07%) and housing price growth (6.77%).

Scenario 2 - Low Growth, Higher Wages

In this scenario we will assume housing prices grow at 2% annually and household incomes grow at 3%.

Scenario 3 - Best Case Scenario Without Price Falls

In this scenario we will assume housing price growth flatlines and household incomes grow at 3%.

The Parameters

In the various scenarios the following assumptions will be made:

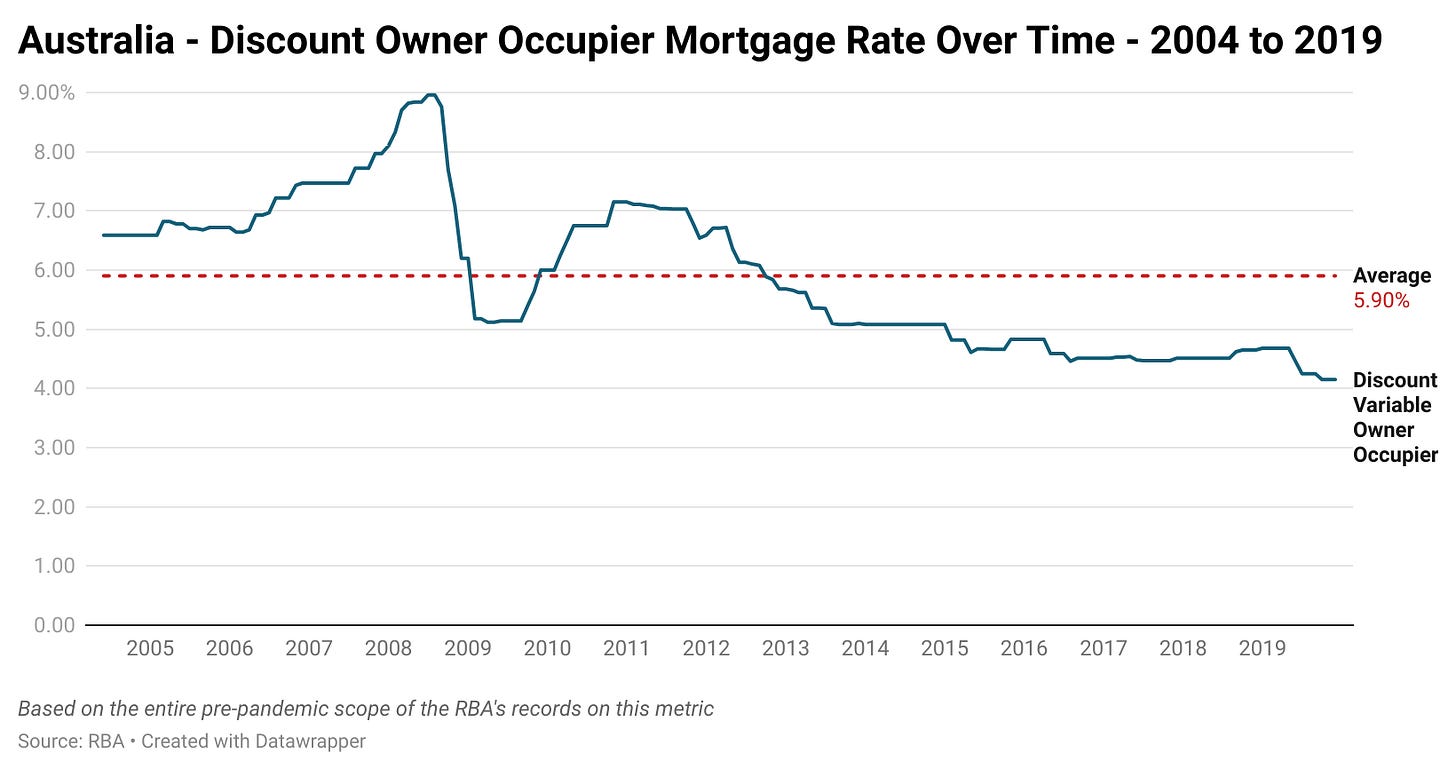

Mortgage rates at 4.75%. This is roughly 0.75 percentage points below the current average payable owner occupier variable rate and significantly below the longer term average.

The hypothetical buyer has a 5% deposit and the required funds for stamp duty.

Affordability will be defined as repayments equalling 35% of gross median household income, with that income growing by the level laid out in each scenario.

To Infinity And Beyond

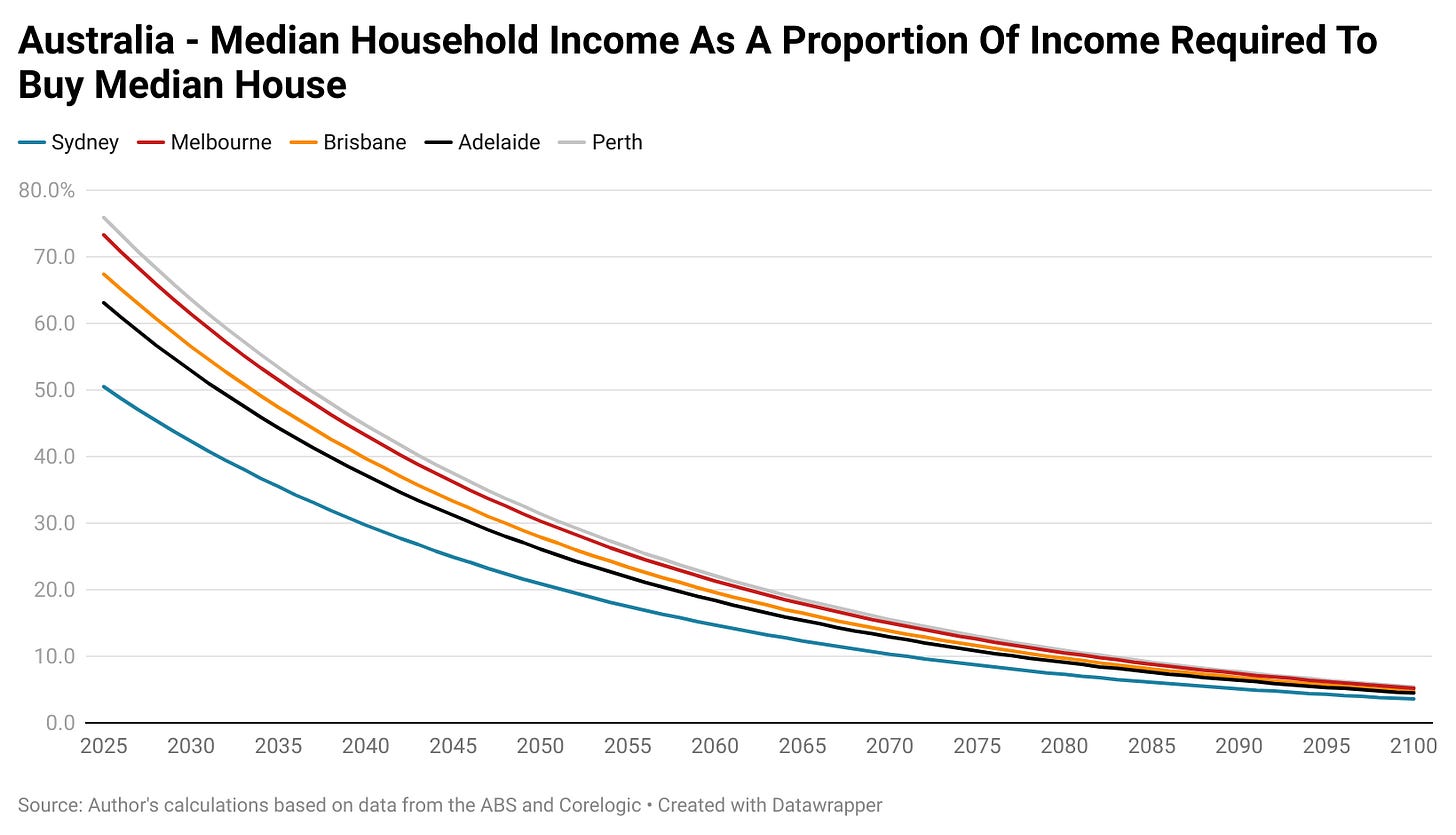

As you might imagine if we see a repeat of the last 25 years, housing affordability will once again deteriorate dramatically. Rather than getting deep into the figures on this rather bleak outlook, the table and graph below details what proportion of the median household income over time represents of the total required income to buy the median house in a particular city and have repayments be equal to 35% of gross household income.

If you are curious about a given point in time and want greater clarity, I have included a link below each of the graphs to an interactive version where you can mouse over any given point for a more precise figure.

Low Growth, Higher Wages

If somehow policymakers were able to wave a magic wand and create a scenario in which housing prices still grew, but at 2% per year and household incomes rose at 3% per year, it would take roughly 36 years for the median house nationally to become affordable to the median earning household under the conditions laid out today.

Keep reading with a 7-day free trial

Subscribe to Avid Commentator Report to keep reading this post and get 7 days of free access to the full post archives.