More Engines Flame Out For The Aussie Consumer Economy

An even shakier economic foundation and another age demographic is going backwards

In recent years the issue of the distribution of Australia’s household consumption by age has increasingly made headlines.

In a vacuum, the push for greater levels of real consumption from retirees in aggregate has been successful, with the spending of over 65s in particular seeing a meteoric rise over the last two decades.

This is something that I have covered extensively in the past based on ABS data provided to me by the Reserve Bank.

In the last 3 years the proverbial data baton has been taken by CommBank iQ, which breaks down per capita spending by age demographics (ex-housing) using its own internally sourced data.

Since it was first released in 2023, it has revealed that the profound divergence in consumer spending outcomes by age demographic seen in the ABS data has not only continued, but accelerated dramatically.

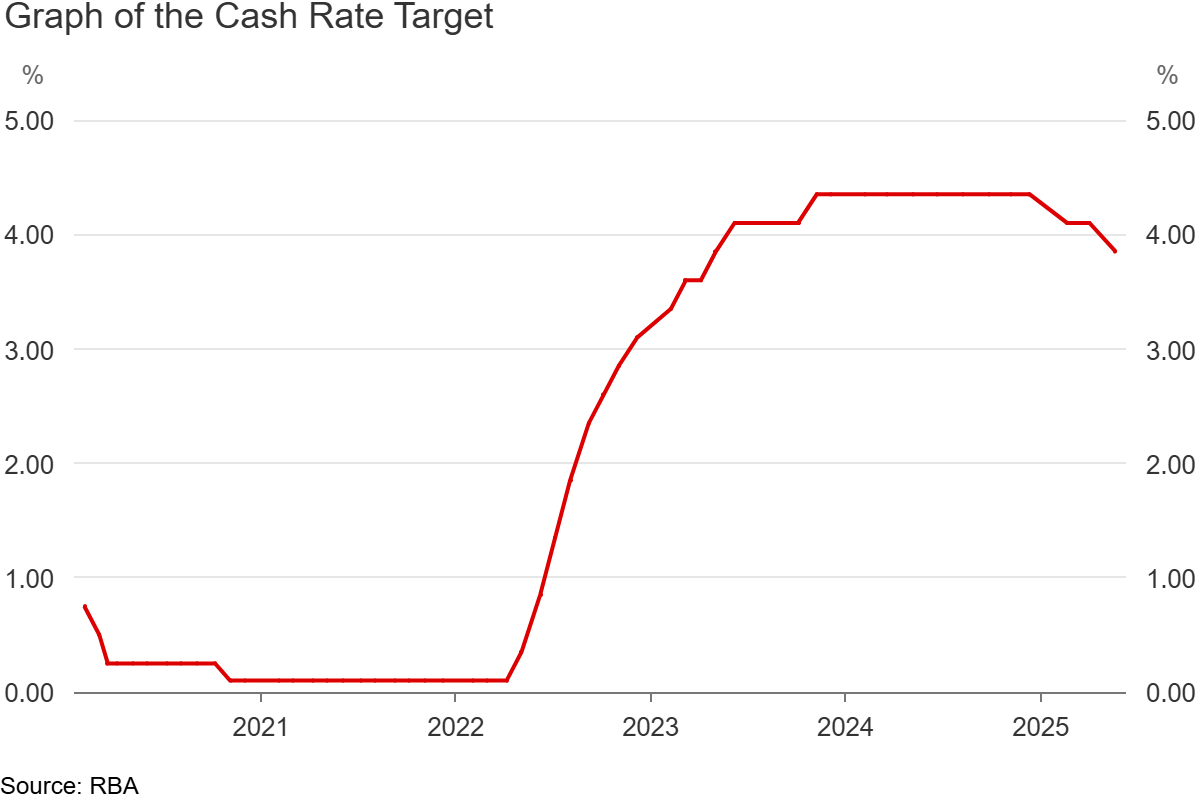

Amidst the highest levels of inflation in over 30 years, the swiftest and largest relative rise in interest rates on record, and the meteoric rise in asking rents, a large number of Australians have faced the most challenging conditions for households in a generation.

And it shows.

In order to assess how households are faring on an individual basis and by extension the consumer economy, we’ll be looking at the following:

Consumer spending growth by age demographic over the last 12 months of data

Consumer spending growth by age demographic since the start of the CommBank iQ data set in Q1 2022

Total consumer spending broken down by age demographic in nominal terms, to illustrate which demographics spend the most on a per capita basis

Putting it all together with age demographic breakdown data from the ABS, to determine what share of overall consumer spending is powered by each age demographic. In short the level of per capita spending multiplied by the relative size of each age demographic.

The Now

Looking at the last 12 months in isolation, all age demographics under 65 have seen their household spending (ex-housing) go backwards in aggregate real terms.

The largest and most severe deterioration between Q1 2024 and Q1 2025 was in the 30 to 34 age demographic, where real household spending fell by 2.8%, followed by the 35 to 39’s, where spending fell by 2.5%.

At the other end of the spectrum, the 75 and over demographic saw the largest rise in real spending, up by 4.3%, followed by 65 to 69’s who saw their aggregate spending up by 1.6%.

The impact of rising interest rates has frequently been held responsible for the lion’s share of the deterioration in real consumer spending. But the simple reality is, the Q1 2024 post dates the end of the rate rise cycle, which occurred in November 2023.

If we take the final 0.25% rate rise in November 2023 out of the equation, made by then newly minted RBA Governor Michele Bullock, rising interest rates were largely done in June 2023, 6 months before the Q1 2024 data set.

Yet we have continued to see household spending deteriorate over a larger and larger share of the nation’s age demographics.

The Slightly Longer View

When we take our perspective back a ways and base it on Q1 2022, it reveals a technical depression in the household consumption spending of 25 to 29’s.

In the last 3 years their real per capita spending has fallen by 13.6%.

While I lack a data set breaking down household consumption spending going back further than 2001, one can’t help but imagine that this level of deterioration has not been seen since at least the 1970s, if not the dark days of the Great Depression.

Keep reading with a 7-day free trial

Subscribe to Avid Commentator Report to keep reading this post and get 7 days of free access to the full post archives.