Recession Warning Lights Are Flashing For The U.S Economy

A paradox of supply chain woes, inventory builds and weakening economic indicators

In the past two years most of us have been given a crash course in how the world’s supply chains function and exactly how fragile they are. Amidst pandemic driven interruptions, the impact of government stimulus programs and displaced services spending, supply chains simply couldn’t keep up under this perfect storm of circumstances.

At first glance, U.S businesses have quite a bit of work to do to rebuild their inventories to pre-pandemic levels, suggesting that this driver of headline GDP growth may still have more than a bit of gas left in the tank.

But like so many things since the pandemic began, things are not what they seem.

The drop in retailer inventories has been driven almost entirely by automotive inventories becoming practically non-existent. Prior to the pandemic U.S auto inventories were trending down significantly, but still remained at a level of around 500,000 to 600,000 units.

Today they sit at just 65,000.

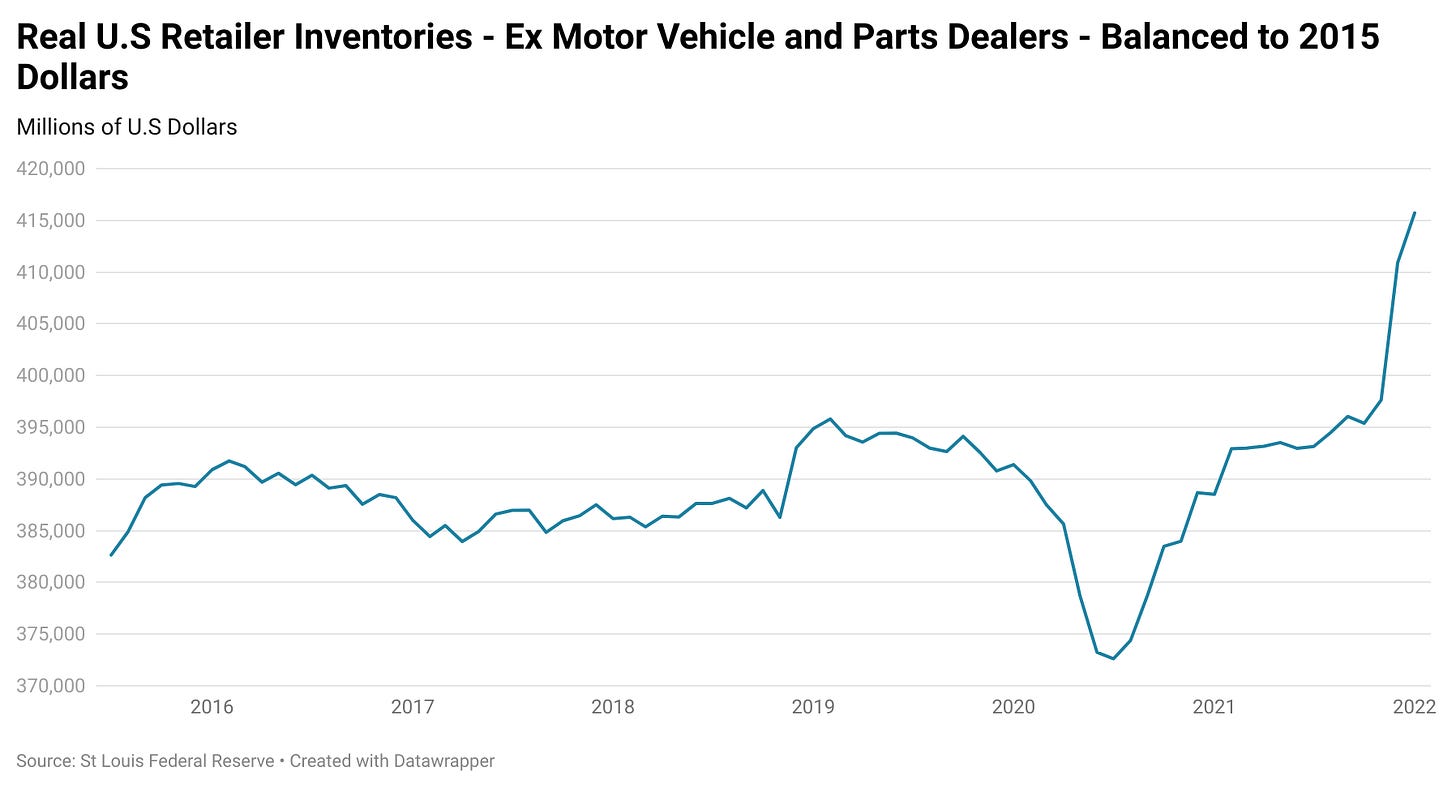

When looking at inventories from a broader perspective that excludes the huge deterioration in auto and auto part inventories, the picture changes dramatically.

All of a sudden what appeared to be a major inventory deficit becomes a large inventory build that is significantly above pre-pandemic levels. Much of this sizable inventory build has taken place in the past few months, with inventory data showing some of the largest month on month inventory builds in American history.

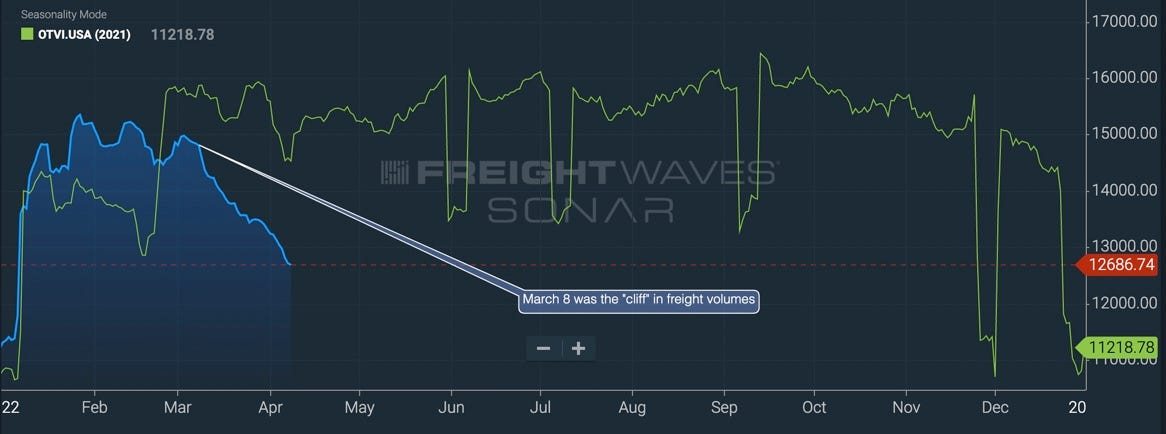

This growth in retailer inventory is reflected in demand for U.S truck based freight. According to FreightWaves’ contract truckload market index, demand for truck transportation has fallen by 15% since the start of March.

When contrasted with the trend and seasonality present in 2021’s figures, its clear a major shift in freight demand has occurred.

Ironically Walmart’s plans to pay new truck drivers a salary of $95,000 to $110,000 pretty much nailed the top for freight demand.

The recent ISM PMI also showed some significant signs of weakness, with new orders surprising to the downside.

On the face of it, the data seems to be pointing to a garden variety economic slowdown, with an inventory glut to potentially act as a disinflationary or even deflationary force for a time.

This is where our scenario takes a turn for the paradoxical, where the waters get muddied and some of the traditional economic indicators become much less useful.

Despite the ongoing inventory build by U.S retailers, lockdowns and Covid restrictions in China continue to point to interrupted supply chains and the potential for shortages for the foreseeable future.

According to data from maritime analytics firm VesselsValue, the number of ships waiting to load or unload at the port of Shanghai recently hit over 300. To put this figure into perspective the number of ships waiting at the ports of Los Angeles and Long Beach peaked at a little over 120.

But its not just Shanghai that is being impacted. According to a recent analysis by the Wall Street Journal, cities accounting for around 40% of China’s economic output are currently in lockdown. Speculation continues to build that other major Chinese cities could soon follow.

As all of these various factors converge, a complex and challenging picture emerges.

When you subtract inventory building from the Q4 2021 U.S GDP figures, its clear the U.S economy was already approaching stall speed. With broader retail inventories now well above pre-pandemic levels and auto inventories unlikely to normalize for the foreseeable future, slowing inventory growth and even inventory draw downs may act as headwinds for U.S growth in the coming quarters.

At the same time U.S consumer sentiment is currently sitting at a level consistent with the great recession and the early 1990’s recession.

Despite historically poor levels of consumer confidence and growing concerns about inflation, U.S consumer credit growth has recorded multiple record high increases in recent months. Households are seemingly turning to their credit cards in droves as they attempt to maintain their standard of living against a backdrop of rapidly rising costs.

Yet despite a weakening U.S economy, inflation may be here to stay. Between lockdowns in China and the war in Ukraine, it appears that supply chain disruptions will remain an issue for the foreseeable future.

Ultimately, none of this is positive for the U.S economic outlook. With inventories well above pre-pandemic levels as demand for goods in real terms continues to fall, in the quarters to come, headline U.S GDP figures are likely to reflect a stalling economy as several key tailwinds come to an end.

But that doesn’t mean inflation is necessarily going away. Supply chain issues driven by lockdowns may continue to drive higher prices for some key goods even as demand falls away. Meanwhile upward pressure on commodity prices may continue as the war in Ukraine and sanctions continue to impact supplies.

Going forward there is also the wildcard of widespread political unrest globally impacting the flow of goods and commodities. Recent scenes in Sri Lanka, Peru and Pakistan have illustrated that this threat is very real.

— If you would like to help support my work by donating that would be much appreciated, you can do so via Paypal here or via Buy me a coffee. Regardless, thank you for your readership.

Thanks for this excellent article! Someone pointed out the divergence between consumer spending (up) and consumer sentiment (down) on Twitter recently, and I wondered what's behind it. The growth in consumer credit you mentioned might well be the missing link: "Households are seemingly turning to their credit cards in droves as they attempt to maintain their standard of living against a backdrop of rapidly rising costs."

I'll buy you a coffee if I can claw back last weeks losses, Avid.