Resuming Student Loan Payments To Drive U.S Into Recession?

The straw that could break the camel's back?

Over the past 27 months the vast majority of Americans with student loans effectively haven’t had to pay them, after the initial forbearance in loan repayments introduced under President Trump was extended time and time again by both Trump and his successor President Joe Biden.

Based on the latest available data, the ongoing loan forbearance is injecting up to $20.8 billion per month into the U.S economy. While its worth noting that this figure is based on all loans in forbearance not being repaid, data from the New York Federal Reserve shows that just 9% of direct borrowers made any progress in paying down their loans during the forbearance and 0% interest period.

But this period of forbearance is now set to draw to a close. Starting in October, loan repayments will resume after more than two and half years of this support program providing a sizable stimulus to U.S consumer spending.

With the battle over student loan forgiveness now settled after a Supreme Court ruling and Capitol Hill Democrats agreeing to a resumption in repayments as part of the recent debt ceiling debate, there is now nothing in the way of this economic headwind beginning to impact the U.S economy.

Putting Student Loan Forbearance Into Perspective

When the Trump administration first hit pause on student loan repayments in March of 2020, it was seen as a means to swiftly keep more cash in the pockets of Americans during the pandemic and a potentially protracted period of impacted incomes. It was also a means through which the economy could be supported, by providing households with over $200 billion a year in additional cash.

Ironically there is a strong argument to be made that allowing student loan forbearance to continue long after lockdowns and the impact of the pandemic had been replaced by a booming economy contributed significantly to the current inflationary pressures.

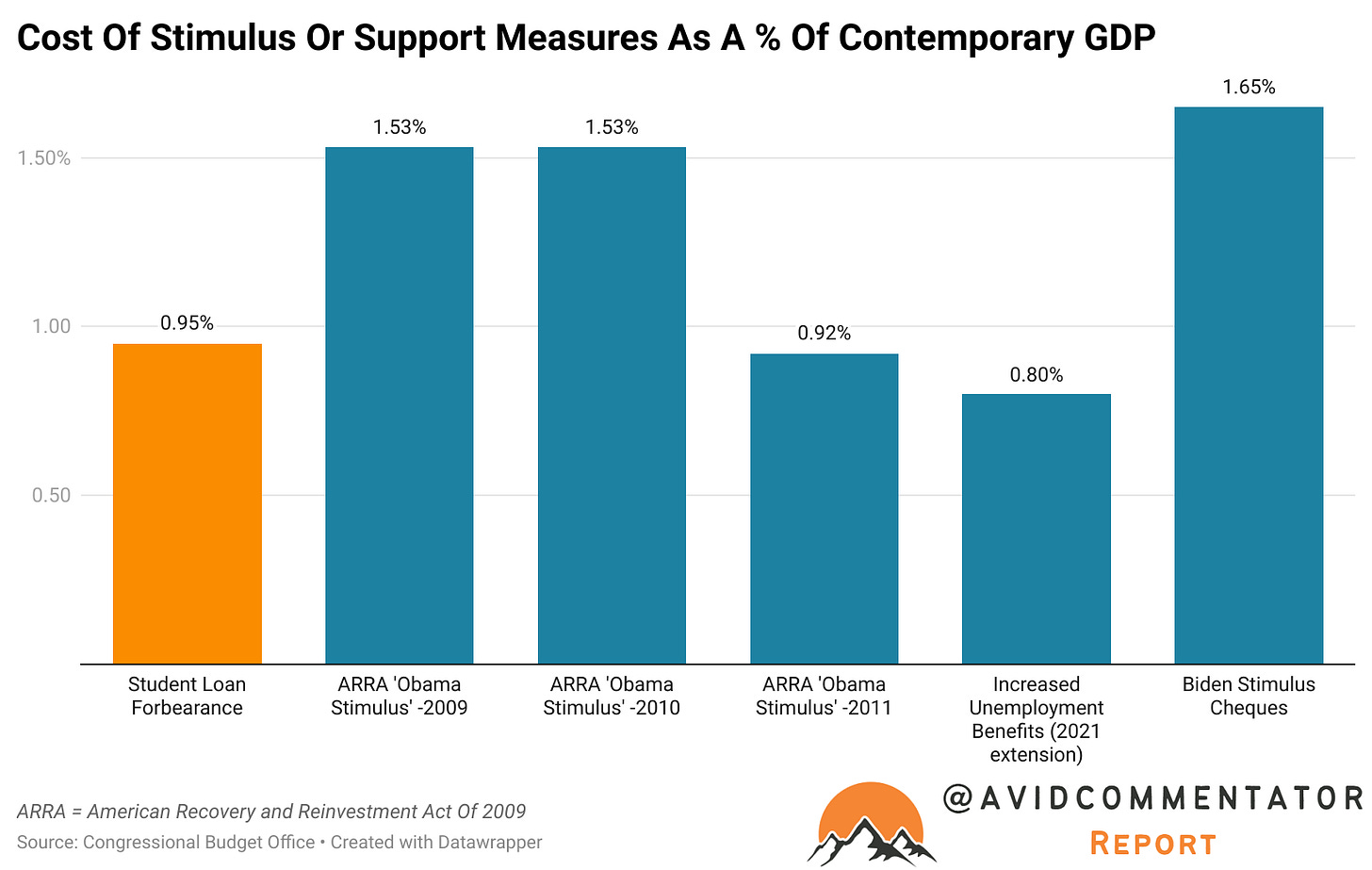

While up to an additional $250 billion in the pockets of consumers may not seem like a huge number when put into the context of the United States $25 trillion dollar economy, when contrasted with previous stimulus measures it becomes clear it has been a significant driver of economic activity.

According to a 2009 paper authored by Moody’s Analytics Chief Economist Mark Zandi, providing lump sums to households in the form of a tax rebates would increase GDP by 122% of the value of that payment over the course of the next year.

While other estimates of how payments to households or tax credits impact the economy can vary quite widely depending on the source, large scale transfers to households remain a major driver of economic activity when implemented.

The Broader Economic Backdrop

While the conclusion of the student loan repayment pause is arguably insufficient to drive a healthy economy into recession on its own, for an economy that is gradually deteriorating and slowly beginning to feel the effects of the largest relative monetary policy tightening cycle in American history, it may be enough to tip the scales into recession given sufficient time.

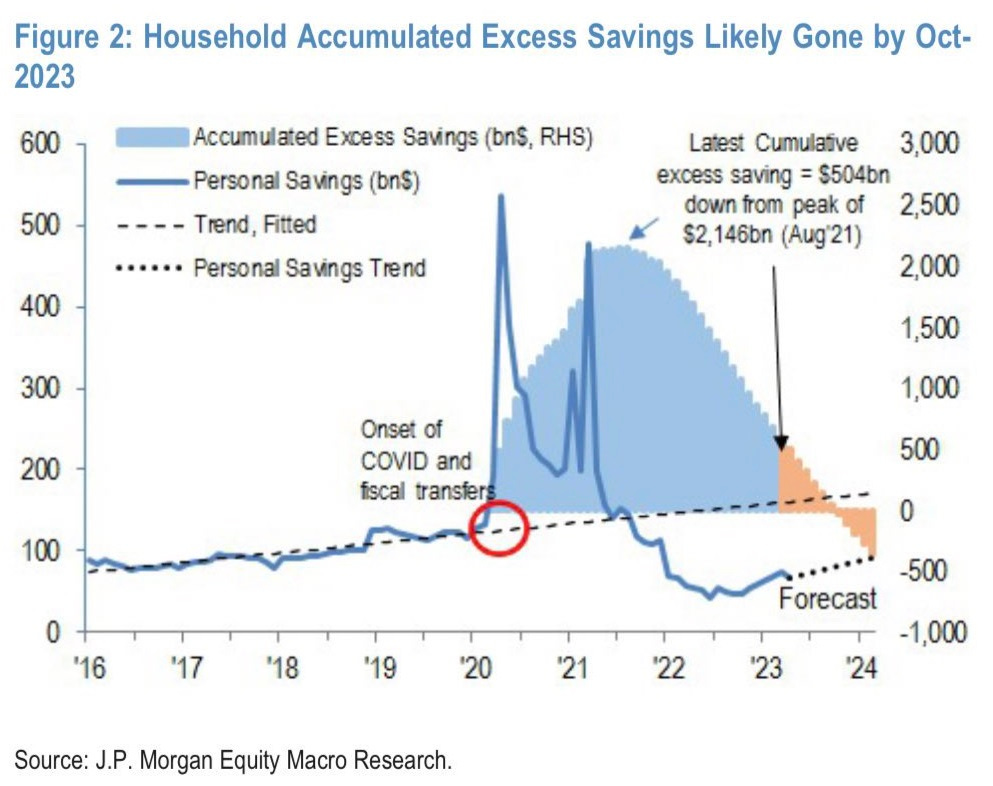

There are also other downside factors that will be beginning to impact the U.S around that time. According to an analysis from JP Morgan, the total pool of excess household savings will be gone by October.

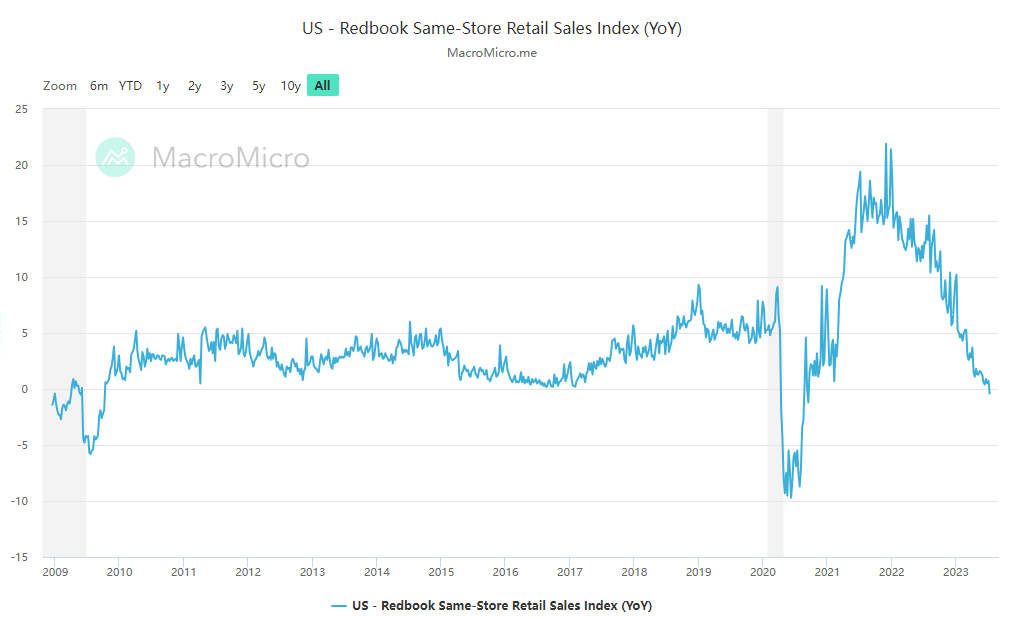

Meanwhile the signs from U.S retail are not looking all that flash. The Redbook Same Store Retail Sales Index is currently contracting for the first time since October 2009. This index is not adjusted for inflation, so a contraction is arguably all the more concerning.

A major part of the relative decline in U.S retail sales is driven by the shift toward services spending, as the pandemic faded and retail spending patterns began to normalize. Real retail sales still remain above trend, so there is arguably a degree of downside to come even without a more serious economic downturn occurring.

The Straw That Breaks The Camel’s Back?

So far the U.S economy has proven to be remarkably resilient, but as the headwinds continue to multiply the big question is how much longer that can continue.

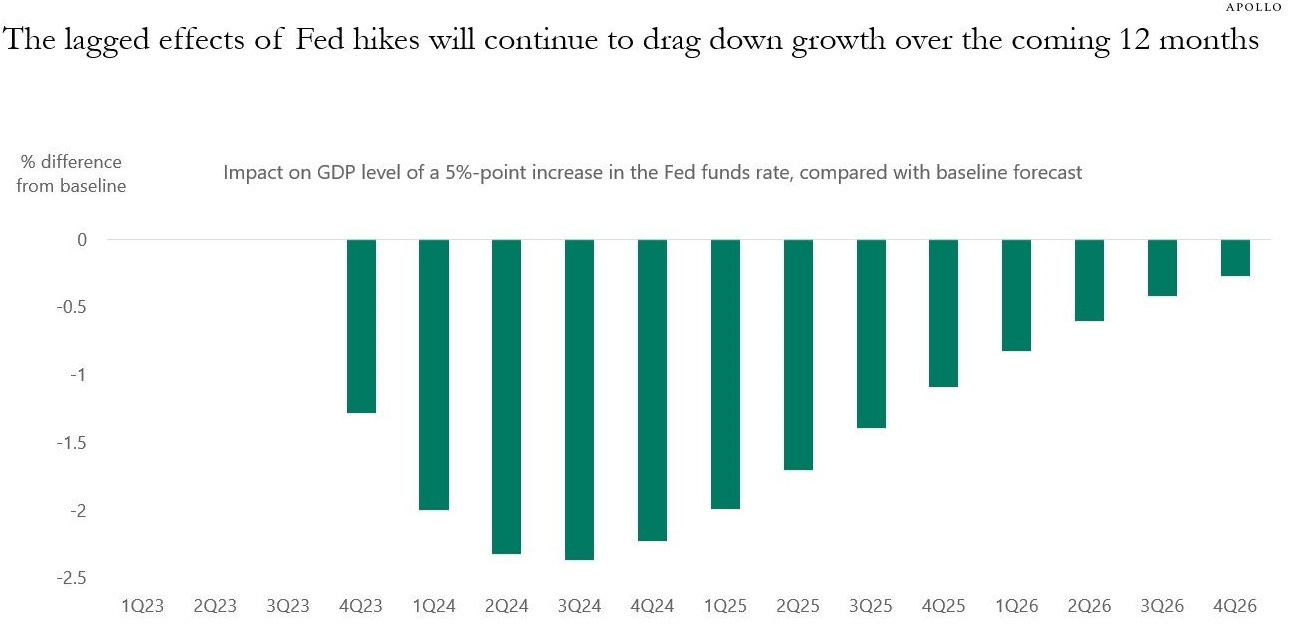

According to an analysis by Apollo, the impact of the Fed’s tightening will begin to meaningfully begin feeding into headline GDP figures in Q4, before hitting a peak impact of almost -2.5% of GDP in Q3 of 2024.

Between this, the resumption of student loan repayments and the expected exhaustion of excess household savings, it appears that Q4 is where the real challenge will kick off for the U.S economy. However, these headwinds are going to slowly intensify over time, as households are forced to reconsider their spending habits.

The big question is when that could be the straw that breaks the camels back. After the largest and fastest relative tightening cycle in American history, the consensus over the path of the economy has been on a rollercoaster ride. During 2022 a recession was seen as extremely likely. While one did occur in technical terms (two consecutive quarters of negative growth), it didn’t as defined by the National Bureau of Economic Research or NBER, who are the ultimate arbiters of calling U.S recessions.

Now investors and analysts are increasingly bullish that the U.S may be able to pull off a soft landing and avoid a recession. As downside drivers continue to multiply, I doubt they will be able to achieve such a result.

Ultimately U.S recessions are called when they are well and truly in the rear view mirror. And we might end up being surprised by exactly how early a recession ends up being pencilled in as kicking off.

Brief note: After recent messages of support and pledges to pay a monthly subscription, Substack subscriptions have been turned on at $10 AUD per month and $100 AUD per year. All content will remain free, but if folks want to choose to support my content in this way they can and that would be greatly appreciated.

— If you would like to help support my work by making a one off donation that would be much appreciated, you can do so via Paypal here or via Buy me a coffee. Regardless, thank you for your readership.

If you would like to support my work on an ongoing basis, you can do so here via Patreon or via Paypal here

Great piece Tarric. Wishing your father well too.

“President” Joe Biden? Oh please. Now there’s a downside driver.