The Aussie Private Sector Economy Is In Deep Trouble

Huge population growth, no growth in market hours worked

After doing the recent roundup on market vs non-market jobs, I was left with a feeling that there was more interesting insight to be had. So I commenced a deep dive of all the various data points attempting to piece together a more complete picture of the underlying state of Australia’s labour market.

As the pieces of the puzzle came together, the focus swiftly shifted from the number of jobs, to hours worked and a deeply concerning picture of the labour market emerged.

In order to get a handle on the state of the labour demand within the economy, we’ll be looking at a number of different metrics across a variety of timelines.

Hours worked overall since Q2 2022 and Q2 2023

Hours worked broken down by market vs non-market sectors

A more recent snapshot of overall jobs growth

The Big Picture

Looking at the labour market purely from perspective of a broad overview, two very different pictures emerge depending on where one takes one starting point from.

If we take Q2 2022 as the starting point, since it’s the last quarter of robust broad based economic growth and also coincides with the election of the Albanese government, the headline stats are pretty healthy in a vacuum.

Between Q2 2022 and Q1 2025, the number of hours worked each quarter across the economy has risen by 413.2 million or 7.45%, which is at first glance a very robust result compared with historical norms.

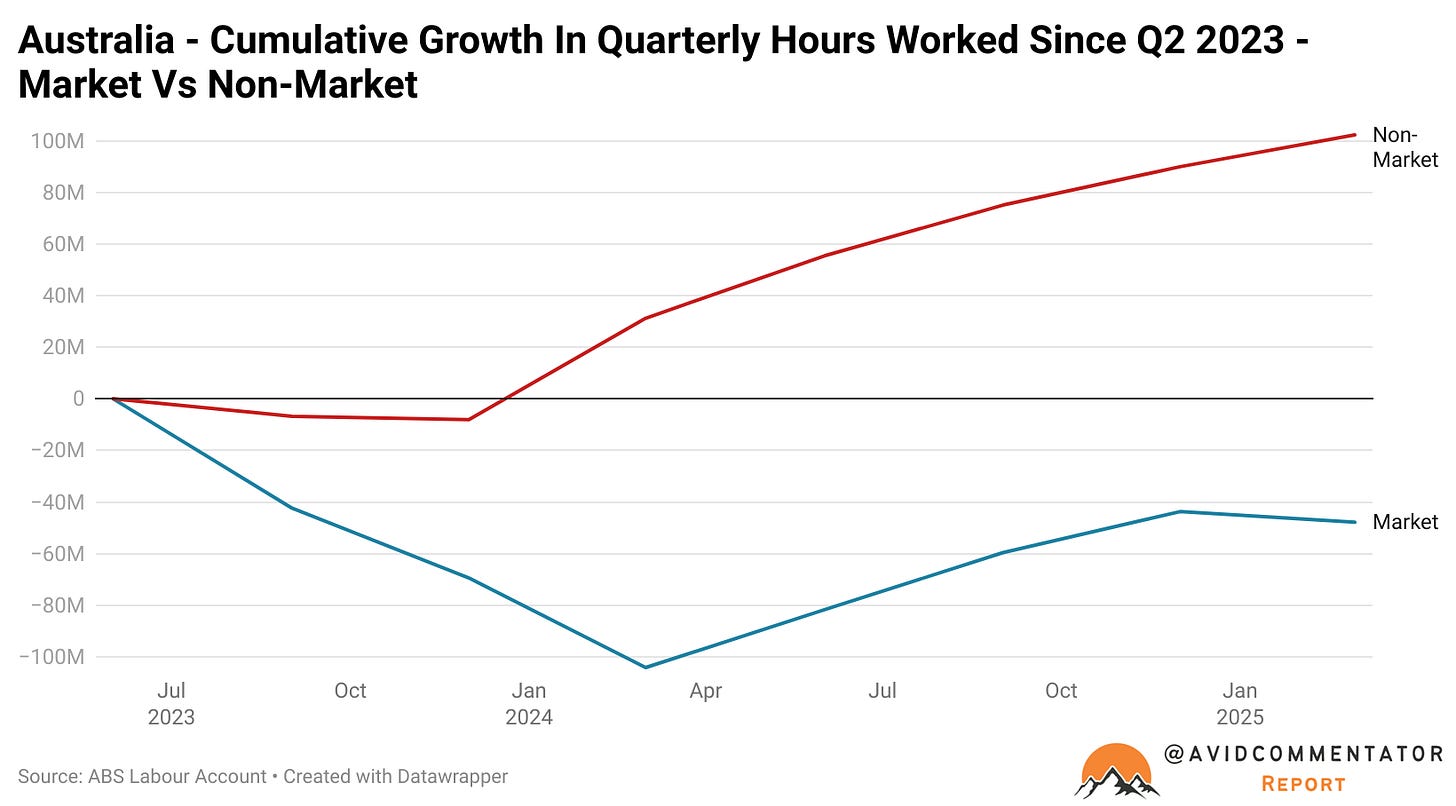

However, when the starting point is shifted to Q2 2023, just a year later, the picture changes dramatically. In the almost two years of data since then, the number of quarterly hours worked has risen by 54.5 million or 0.9%.

In short, despite population growth remaining extremely high since the middle of 2023, the growth in hours worked in the economy just hasn’t kept up.

It’s Dead Jim?

As we previously revealed in the prior analysis of the split of market vs non-market employment here at Burnout Economics, the market sector of the economy is not at all healthy and if forced to support economic growth on its own it would arguably buckle under the burden.

Non-market job’s are defined by the ABS as those in Public administration and safety, Education and, Healthcare and social assistance. Market jobs are those in all other sectors of the economy.

While the growth in market jobs since Q3 2023 has been a less than stellar 39,700, despite the working age population growing by 728,900 across the same time, the news based on hours worked is even more concerning.

Since Q2 2023, the number of hours worked in market based roles has declined by 47.8 million hours per quarter. Across the same period the working age population grew by 895,100 people.

Despite the additional demand of almost 900,000 more working age people needing everything from shelf stackers and mechanics, to truck drivers and plumbers, not a single additional hour in net terms has been worked across the entire market sector of the economy.

Looking at the data from a number of different perspectives, I came across yet another striking fact. Since Q2 2022, the Healthcare and social assistance sector has seen more growth in hours worked in nominal terms than every single market based sector in the entire economy.

Keep reading with a 7-day free trial

Subscribe to Avid Commentator Report to keep reading this post and get 7 days of free access to the full post archives.