The Profoundly Sick Australian Household Economy

Most Australians are going absolutely no where vs their predecessors 20 years ago.

When I first started researching this article after deciding an update to the graph below from the RBA was warranted, the original intent was to illustrate that younger demographics (under 35s) were not spending frivolously in aggregate and that unlike any other generation in decades, they were going no where.

What I found in the data overwhelmingly confirmed that, but also presented a picture for the broader economy that was much worse. It revealed a profoundly sick economy where a majority of households in aggregate had seen their discretionary spending degrade to such a degree that they had gone backwards compared with 2002-03.

In order to get a handle on how households are faring across the different age demographics, we’ll be looking at number of different metrics in inflation adjusted terms:

Total spending growth

Total spending growth ex-housing

Discretionary spending growth

Spending growth on takeaways and restaurants

Given that the ABS data only covers up to the middle of 2022, we’ll also take the liberty of extrapolating what real discretionary household consumption looks like when the performance of the spending of different age demographics in the Commonwealth Bank Cost Of Living survey is added to the mix.

Total Spending Growth

In the years since the RBA produced the report on spending by age demographic, the fortunes of younger households haven’t really changed all that much, their real consumption has continued to decline. For other age demographics for those 45 and older, real consumption peaked in 2017-18 and as of mid-2022, has not recovered to its prior peak.

As of the latest ABS figures, real household consumption for 15-24 is 2.3% below where it was in 2003-04, with spending for those 25-34 down 1.2%. While things improve somewhat from here, the spending of 35-44’s is still 5.3% below where it was in 2007-2008. Overall, all households have suffered falls in real consumption since 2017-18 to varying degrees.

Spending Growth Ex-Housing

When it comes to real consumption excluding housing, which encompasses rents, imputed rent and water, the story becomes even less appealing. Spending for under 35’s is down to a greater degree and a sizable proportion of the total real consumption growth of those aged 35-54 is consumed by housing costs.

Once again the only demographics to have growth which could be considered in the ballpark of being historically strong is the 55-64 and 65 and over demographics. However, once again, the totals for these two groups are significantly weaker than the performance seen in 2017-18. Later in the article we’ll extrapolate the strong consumption growth numbers seen in the Commbank IQ data on to the these numbers to gain a greater perspective on how older demographics are faring relative to the peaks seen in 2018.

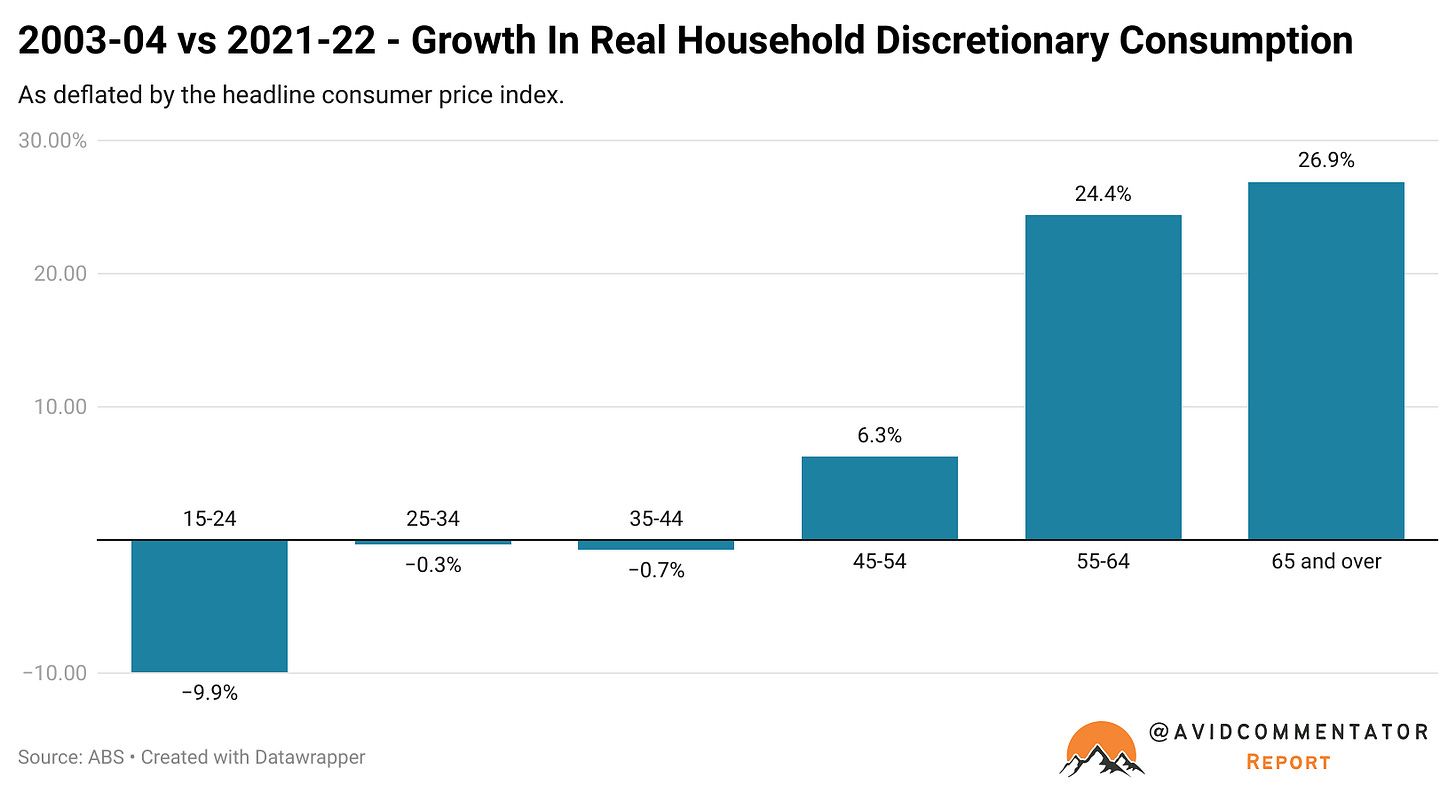

Discretionary Spending

This brings us to something of the main event, the performance of discretionary spending over time. In order to prevent overlap with potentially non-discretionary spending, we’ll be focusing on categories where costs are either heavily tilted by discretionary spending or are entirely discretionary.

These categories are: Alcohol and tobacco, clothing and footwear, furnishings and household equipment, goods for recreation and culture, recreational and cultural services, eating out, accommodation and books, paper, stationery and artists goods.

Real discretionary spending for all age demographics under 45 is lower than it was in 2003-04, with households led by those 15-24 seeing the largest drop of 9.9%.

Even one of the age demographics historically a bastion of home equity withdrawal driven consumption, the 45-54 age group saw real discretionary consumption rise by just 6.3%, despite the fact that this age demo has the highest level of spending compared with any other cohort.

Keep reading with a 7-day free trial

Subscribe to Avid Commentator Report to keep reading this post and get 7 days of free access to the full post archives.