U.S Confidence Collapses to Lowest Ever Outside Recession or Bear Market

Independent voters most pessimistic since the Great Recession

The current state of the U.S economy has been touted as the “Fastest Recovery Ever” and the “Biden Boom” by elements of the U.S media. Yet despite impressive headline GDP growth figures, according to the University of Michigan consumer sentiment survey, confidence peaked back in April shortly after the release of President Biden’s $1.9 trillion stimulus package.

Since then, U.S consumer sentiment has fallen to the lowest level ever seen outside of a recession or a bear market.

Looking at the internals of the University of Michigan’s survey, its clear that concern about inflation and the broader economy have been brewing for almost a year.

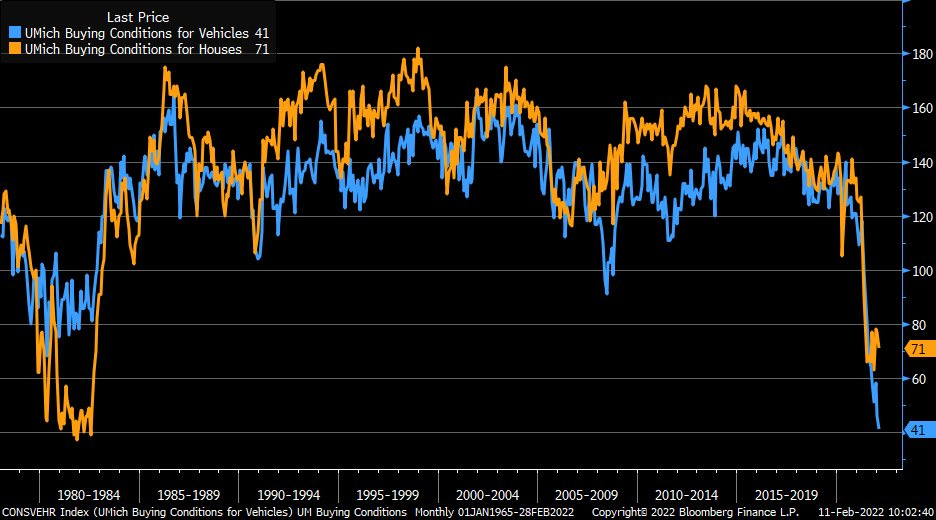

The graph below of ‘Buying Conditions’ for houses, vehicles and durable goods from April last year illustrates that quite well. Despite the fact that headline confidence was peaking at the same time, consumers were already having their sentiment impacted by inflation.

Since then buying conditions for houses and vehicles has continued to fall, with sentiment toward buying a car at the lowest level ever and sentiment for buying a home at the lowest level since the early 1980’s.

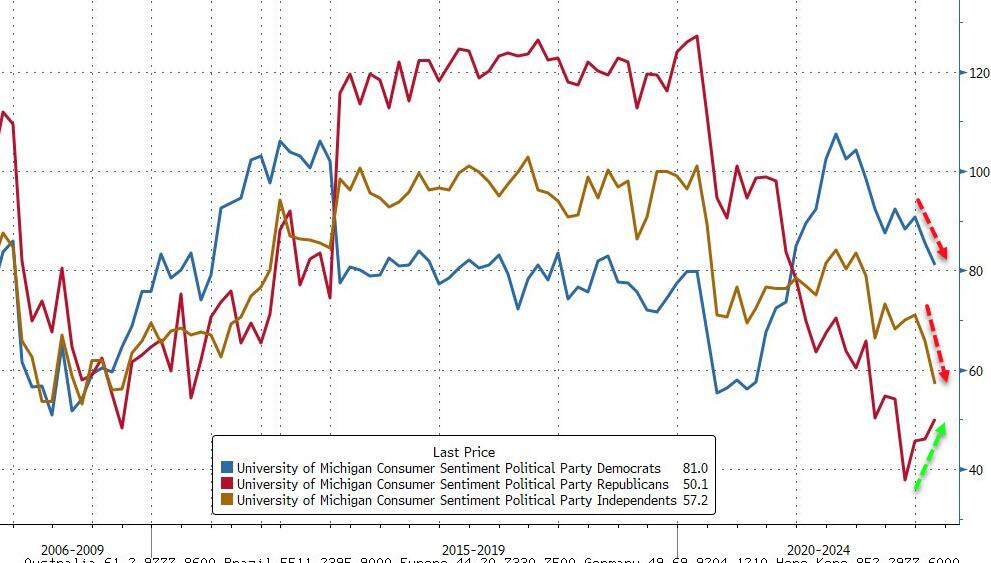

In an interesting turn of events, even Democrats are slowly losing confidence in the U.S economy, despite experiencing a sizable leap when President Joe Biden took office.

The fact that they are roughly as pessimistic as when Donald Trump entered the White House and U.S consumer confidence became even more divided along party lines, speaks volumes about how badly economic sentiment has deteriorated.

Personally I find that independent voters are generally the most accurate barometer of the ballpark of where actual confidence lays. Currently that is pointing to the weakest level of confidence since the tail end of the Great Recession.

Considering how U.S households are perceiving the impact of inflation, its perhaps not surprising that confidence is performing so poorly.

According to U.S pollster Gallup, the average American household believes it is currently experiencing moderate hardship as a result of inflation.

For households in the less than $40,000 a year demographic, 2/3 say that they are experiencing hardship as a result of inflation. That falls to 56% among households earning $40,000 to $99,000 per year and 32% for households earning over $100,000 per year.

With confidence arguably the weakest it has been since 2009 once you attempt to strip out the impact of political biases within the survey, its clear that inflation has become a major drag on American consumer sentiment.

If this continues to impact key data points that serve to illustrate the relative health of the consumer economy, the challenge faced by the Democrats at the upcoming mid-term elections will become even greater and so too likely the hawkishness with which the Federal Reserve will conduct itself in the coming months.

Later tonight the retail sales report for January will be released and this could be a key guide to how the U.S economy is actually faring.

Currently growth downgrades are coming in thick and fast, with the Bloomberg consensus for Q1 now down to just 1.65% (~0.4% QoQ).

Ironically whether the retail sales report comes in hot or weak, it may be further fuel for hawkishness from the Fed, whether its driven by a surprise to the upside due to changed consumer spending patterns distorting the December figure or a surprise to the downside due to inflation dragging on consumers.