Would 0% Interest Rates Make Aussie Housing Affordable

The local counterpart to the recent Zillow analysis of the U.S housing market

A Brief Note: I recently started uploading clips of my chat with Martin North of Digital Finance Analytics to a YouTube channel. If you would like to view those clips or support by subscribing that would be much appreciated.

This is the genesis of something that I hope will grow into something that will be quite valuable for this community on a longer term time horizon.

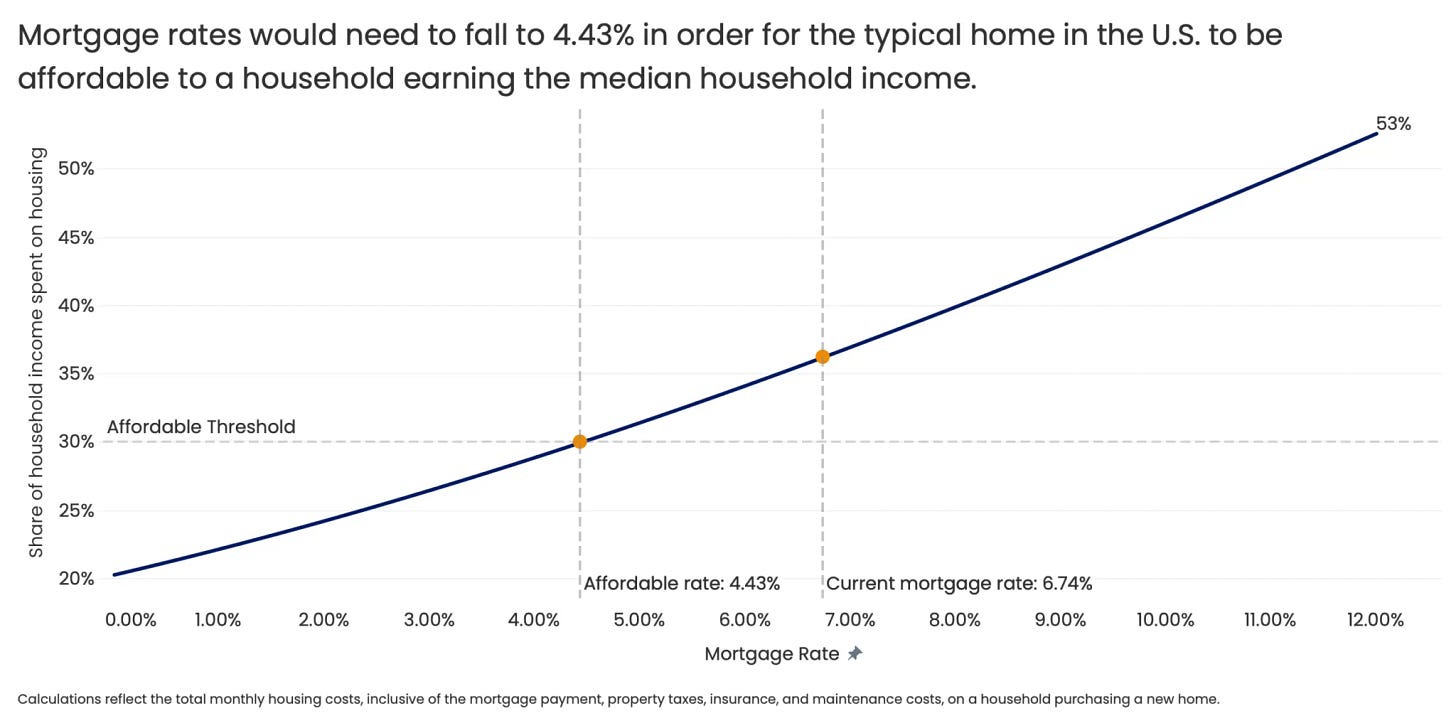

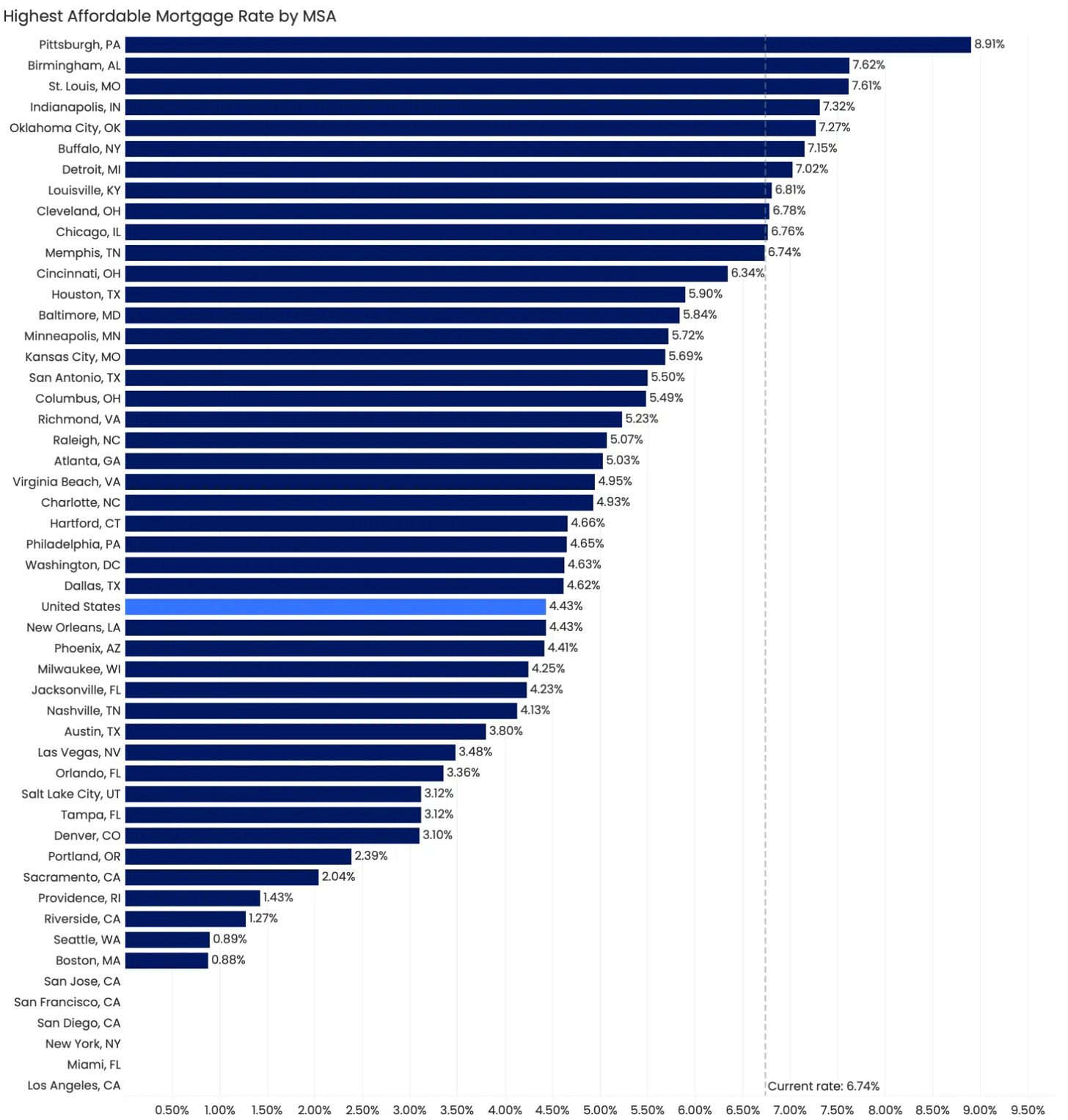

Earlier this month, U.S property portal Zillow published a report detailing how far mortgage rates would need to fall for homes in various cities to be affordable for a typical buyer.

What it found was that U.S mortgage rates would need to fall to 4.43% for the typical U.S home to be affordable for a household on a median household income.

This would represent a reduction in mortgage rates of 2.29 percentage points from the latest 30 year mortgage rates published by the U.S Federal Reserve.

The analysis went through dozens of U.S cities, calculating the rate at which a typical home became affordable for a household on a median household income.

But there were six cities, San Jose, San Francisco, San Diego, New York, Miami and Los Angeles that would not be affordable for a household on a median household income even if mortgage rates went to 0%.

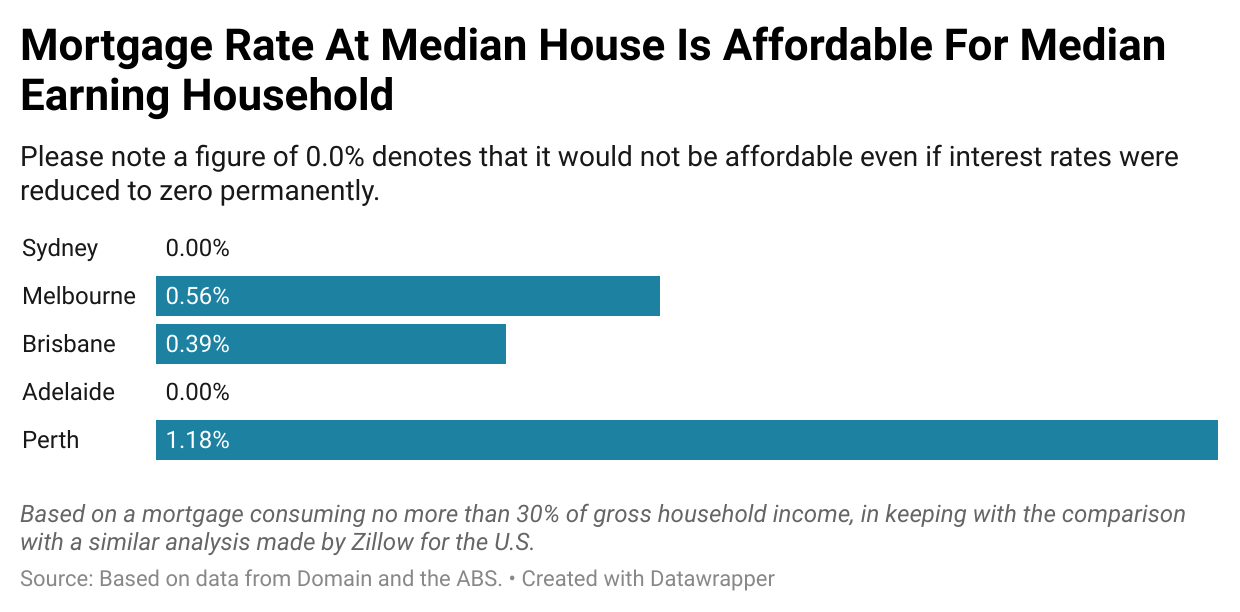

This got me thinking, how far would mortgage rates need to fall in Australia for the median house in the five largest capital cities to be affordable for a household on the median household income?

How Low Can They Go?

As one might imagine, at current interest rates none of the nation’s major cities get even close to Zillow’s definition of affordable, which is mortgage costs taking up no more than 30% of household income.

In today’s analysis we will assume that a household has the required funds for a 10% deposit, as well as cash for stamp duty and other transaction costs.

The first city to hit achieve affordable housing based on interest rates continuously falling until our benchmark is achieved is Perth, with the median house becoming affordable for the median household at a mortgage rate of 1.18%.

The next is Melbourne, with the median house becoming affordable at a mortgage rate of 0.56% and Brisbane with a figure of 0.39%.

Zero Rates Not Enough

In Sydney and Adelaide, mortgage rates could fall dramatically and keep falling all the way to 0% before becoming affordable for the median earning household.

In Adelaide, an income 7.5% higher than the median would be required in order to achieve Zillow’s chosen metric of affordability.

In Sydney, the worst performer of the bunch, an income 37.9% higher than the household median would be required in order to be able to afford the median house with zero interest rates.

A More Realistic But Larger Than Expected Cutting Cycle

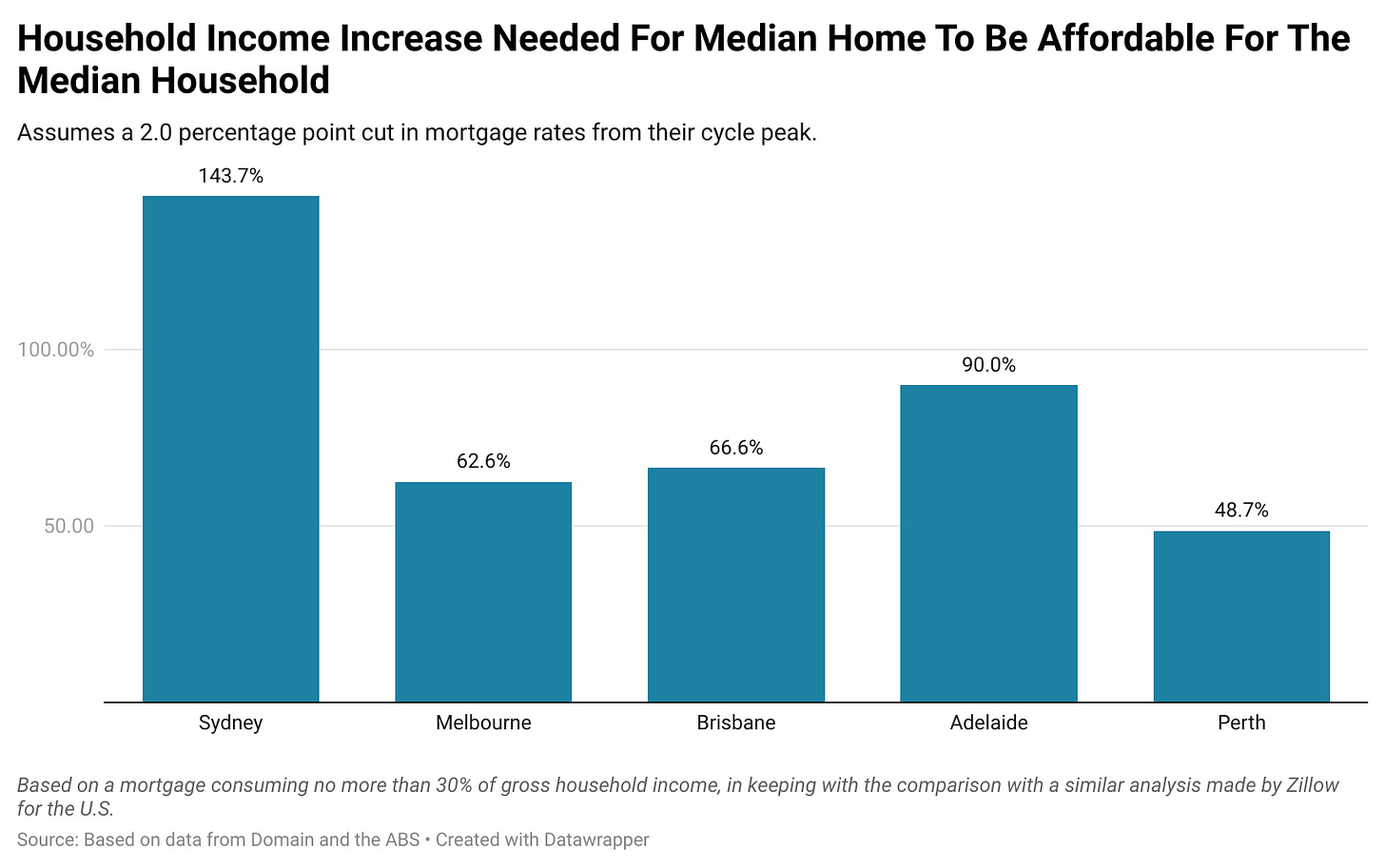

If we take a more realistic approach under which the average payable owner occupier variable rate is cut by two percentage points, significantly more than is currently being priced in by financial market, the picture for affordability gets significantly more challenging.

At this interest rate, the median Sydney household would need to earn 143.7% more in order to be able to afford the median house.

At the other end of the spectrum, the median Perth household would need to earn 48.7% more in order to be able to afford the median house.

Deepest Rate Cut Cycle Ever Rerun

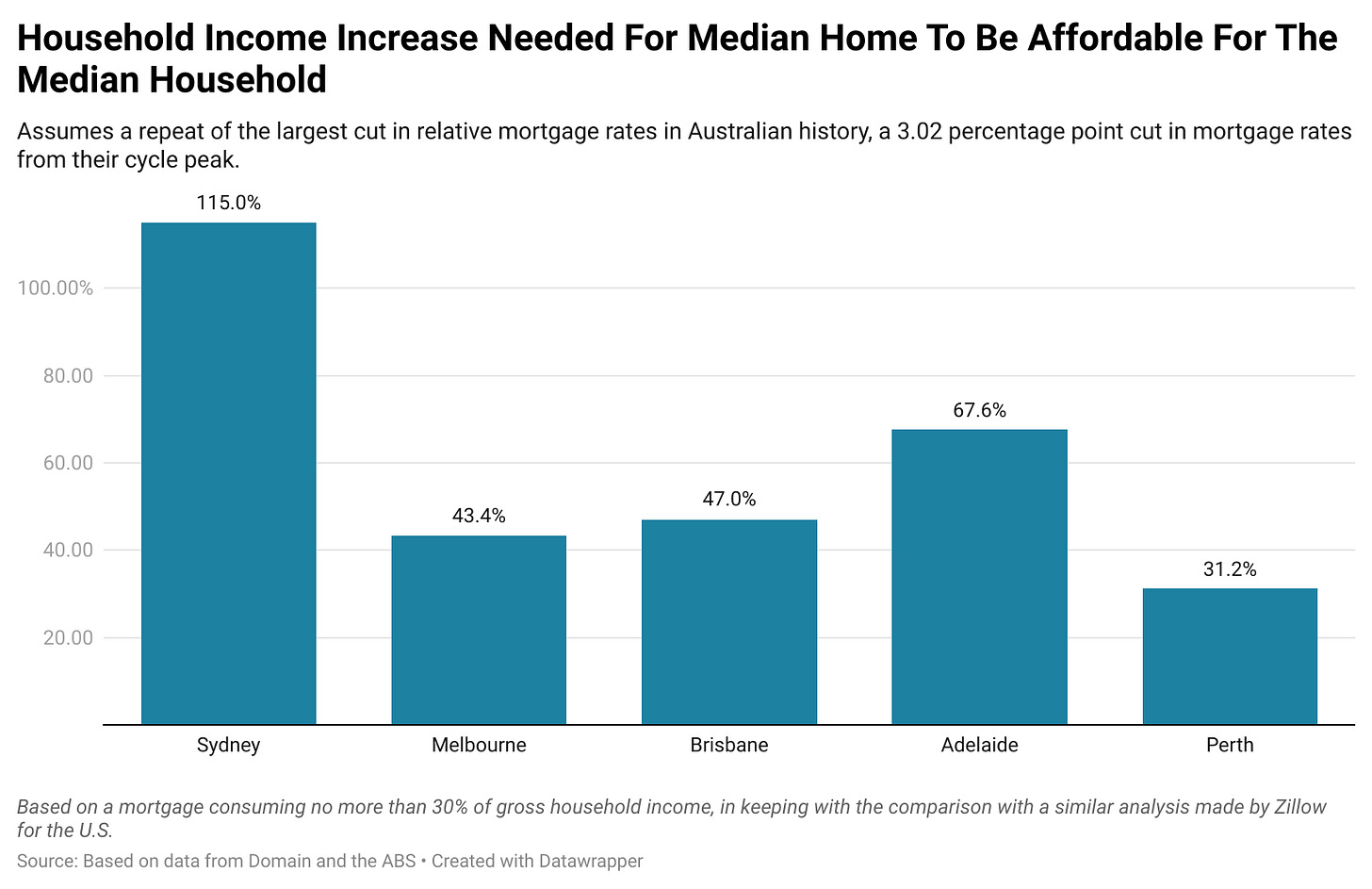

In order to give the next scenario the best possibility of success, we’ll assume that the average payable mortgage rate sees a rerun of the largest relative cut’s in mortgage rates in Australian history, during which mortgage rates fell by 48.5% in relative terms.

This almost halving of mortgage rates would leave the median Sydney household in need of an income increase of 115.1% to meet the affordability criteria.

In Brisbane, household income would need to increase by 47%, in Adelaide by 64.6%, Melbourne by 43.4% and Perth by 31.2%.

The Outlook

Interest rate cuts can in a vacuum help more prospective buyers into the housing market, but as these various analysis show, they are far from a silver bullet solution, even if some of the more extreme scenarios put forward here were to be realized.

Rate cuts also don’t play out in a vacuum, they have historically placed further upward pressure on housing prices, in time alleviating whatever gains in affordability may have been relatively briefly on offer.

In today’s context when it comes to achieving affordable housing there are the two main factors, mortgage rates and the price of homes.

If affordable housing cannot be achieved by any reasonable or even unreasonable level of interest rate cuts given the circumstances we currently find ourselves in, then the focus realistically needs to be on bringing housing prices down.

As I have covered previously in detail here at Burnout Economics, there is technically a pathway in which affordability can be achieved by either stagnating prices or prices rising less than wages.

But as that piece covered, even my much more achievable definition of affordability at a national level would still take well over a decade to achieve assuming that housing prices stopped growing at the end of the first quarter of this year, with the capital cities in aggregate taking longer again.

Australia’s housing market is in need of a profound change and a dramatic reduction in housing costs to help boost the economy and assist younger demographics out of the proverbial hole driven by the loss of the last two decades worth of consumption growth.

There is no one answer that is going to completely solve this issue, no silver bullet, but one factor will likely need to be bringing down the cost of building a new home, which we will be covering next time for paid subscribers here at Burnout Economics.

— If you would like to help support my work by making a one off donation that would be much appreciated, you can do so via Paypal here or via Buy me a coffee.

If you would like to support my work on an ongoing basis, you can do so by subscribing to my Substack or via Paypal here

Thank you for your readership.

Neat and highly appropriate mode of analysis. Great work.

It could be extended in the following manner:

1) What might be affordable, in terms of the price of a dwelling, at zero interest rates, for a working couple on the minimum wage.

2) What is the availability of dwellings at that price across the capitals? Outside the capitals?

3) Would the situation be tenable if the couple did not have to own two cars?

4) What sort of house might be built in what sort of circumstances to provide a dwelling for a couple, both earning at the level of the minimum wage?

5) Lets assume that the caravan and camping regulations are relaxed to enable people who own land in rural and rural residential zonings to accommodate fully serviced 'tiny homes', caravans or 'park homes' that they, the landowners own. What per unit outlay would be justified if the requirement is a return of 10% on capital invested, were the per unit rental to be $300 per week?

6) Is it possible under the existing planning regime to provide a house that is affordable to a couple, both earning at the minimum wage level, in the subdivisions that are being created across the country at this time?

7) What changes in the planning regime would allow the creation of housing that is affordable for a working couple earning the minimum wage?